Money view of the MakerDAO/Morpho/Ethena drama

Crypto-twitter is all the rage on the MakerDAO/Morpho/Ethena combination that may result in up to $1B of MakerDAO’s balance sheet allocated in loans backed by Ethena USDe and sUSDe collateral (for simplicity let’s stick with sUSDe which accrues interest). In this article, let’s look under the hood with a money-view lens.

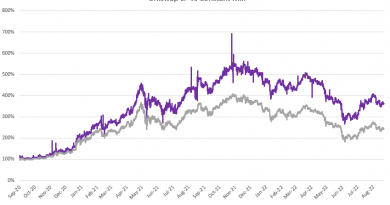

Ethena is more or less a tokenized cash-and-carry trade product where they hold a long spot crypto position (e.g. ETH) and short it on the future market. There are a few twists (we are in crypto after all), but it is similar to the Treasury cash-futures basis trade from TradFi. The crypto cash-future arbitrage isn’t new. It was nicknamed as the “the closest thing to a risk-free bet” by Bloomberg in 2021, it’s back. I would suggest reading the excellent BIS paper Crypto-Carry . As we are in the middle of a bull market the yield of such a strategy generally increases with upward volatility and has ranged from 20-120% APY. This is a significant yield for a “close to risk-free bet” which has attracted significant interest with Ethena growing from $100mm in deposits in early January 2024 to nearly $2B as of this writing (April 3rd, 2024).

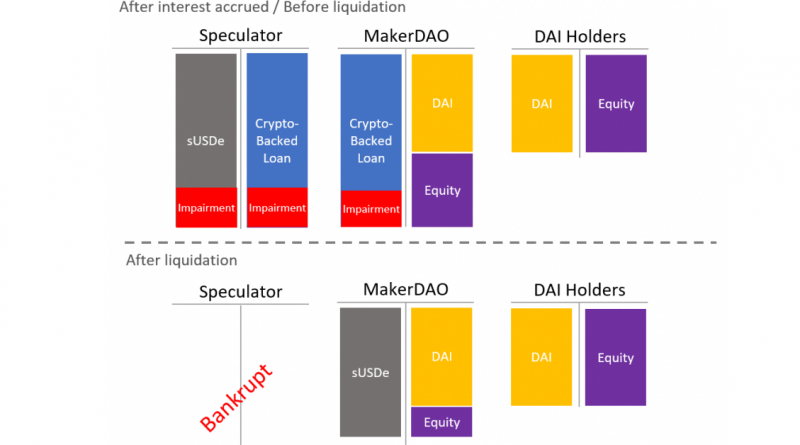

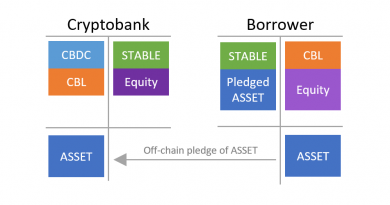

Given the attractive risk/reward, MakerDAO voted to take an indirect exposure to it through collateralized loans backed by sUSDe. What happened is depicted in the diagram below. Starting with assets like T-Bills earning around 5% (as always there are some simplifications), Maker decided to finance crypto-backed loans instead. As you can expect, there were some speculators that wanted more exposure to the 60% organic yield of sUSDe, and were more than happy to use leverage (which even at a funding cost is below the sUSDe yield). The operation didn’t change the balance sheet size of MakerDAO nor its liabilities. It was simply an asset swap. It doesn’t directly impact the DAI holders balance sheet. The US government loses some funding for the benefit of speculators, but I doubt it makes a difference.

MakerDAO has been doing crypto-backed loans since its creation, it’s the bread and butter of the Maker Protocol. What is new is that Morpho was used instead of Maker vault or the newest Spark lending protocol. While Morpho is newer, it is considered by some more secure due to its small and immutable codebase.

Like any highly leveraged loan, the issue is the price feed. Contrary to TradFi, crypto doesn’t wait to liquidate when the collateral is no longer sufficient. Nonetheless, fast liquidations can sometimes be more of a problem than a solution. If there is stress in the market and people start to dump sUSDe, it will quickly depeg from its underlying price (or net asset value), leading to more liquidation and a larger depeg. This could easily lead to liquidation at a price lower than the loaned amount even if there is just a short time of market dislocation. It relates to the very old question about mark-to-model vs mark-to-market.

High leverage and fixed price is not unprecedented, Maker previously had a loan facility for DAI/USDC liquidity pool which let people take a 50x leverage position. The USDC price was fixed at par with DAI. This means the market price didn’t have any influence on liquidations.

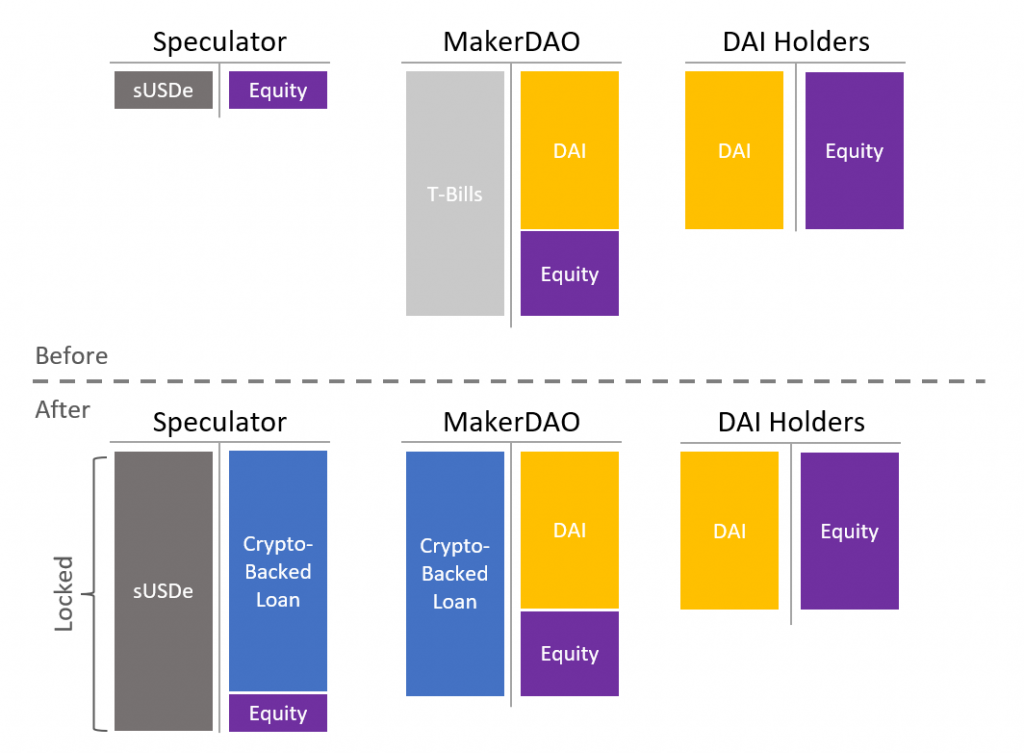

With a fixed price oracle, liquidation only happens when the interest accrued puts the position as liquidable. It is a slow process. One has then a few days, maybe even weeks, to process the liquidation before incurring bad debt. That is at the fixed price. The actual real price might be another story. This is where it becomes asset transmutation.

Let assume sUSDe loses 10% of value during a sustained period of negative funding rates. Lets also assume that the loan-to-value was just below 95%, and that a position gets liquidated at 95% and that there is no liquidation penalty (a bounty for people doing liquidation). The speculator is therefore wiped out and loses everything. The position can’t be liquidated because at this stage Morpho still considers that everything is fine due to the fixed price.

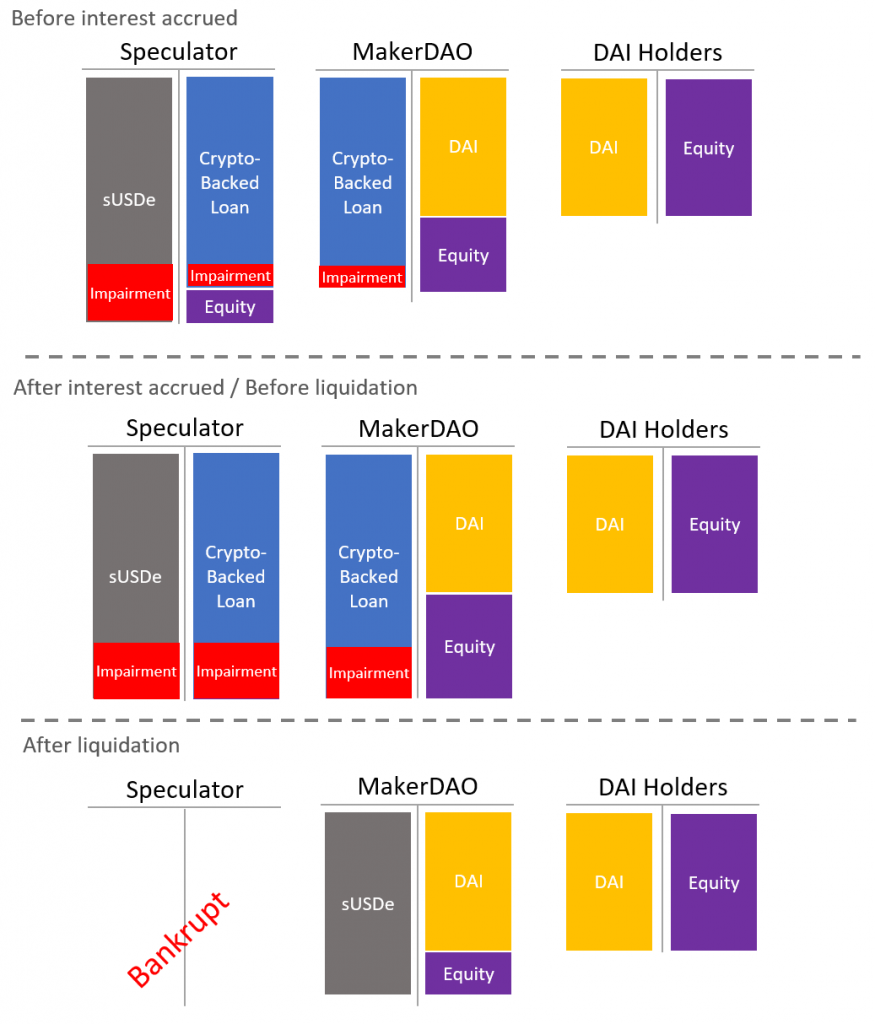

What will happen is that interest will accrue, increasing the size of the crypto-backed loan (both on the liabilities of the speculator and on the asset side of MakerDAO). In the diagram below, the impairment red box represents the difference in sUSDe and for the crypto-backed loan due to the price discrepancy. Notice that as interest accrues, the equity of the speculator shrinks (even with the fixed price) and MakerDAO equity increases (all fictitious in reality). At some point, even with the wrong price, the speculator will be wiped out and liquidation will be possible. One must notice that the liquidation price will still be in a non-impaired position. Therefore, no one will have any economic incentive to liquidate the position. No one but MakerDAO. MakerDAO just has to mint some DAI to repay the crypto-backed loan that it owns (the minted DAI being burned at the end). This is an atomic transaction that will delete the crypto-backed loan and move the collateral (sUSDe) from the speculator to MakerDAO. Assuming sUSDe on the MakerDAO balance sheet is valued at mark-to-market, it will realize the losses on the MakerDAO equity position (and revert all fictitious interest accrued).

As one can see, from a secured lender, MakerDAO is now directly invested in sUSDe. Depending on the loss on sUSDe and the equity buffer of MakerDAO at the time, DAI holders may or may not be impacted.

In conclusion, what is better a crypto-backed loan or investing directly in sUSDe? It’s actually nuanced. Crypto-backed loans allow to trade a slice of the yield for a junior tranche that will take first losses. In case of some negative funding rates and/or small operational losses, it will protect MakerDAO completely. In case of a more significant loss, this protection will be less effective. One can also consider the evolution of MakerDAO liquidity. Is a crypto-backed loan more or less liquid than a direct position in sUSDe? It is difficult to determine. Crypto-backed loans in DeFi have (for most) no maturity and liquidity is achieved by increasing interest rate, at worst until liquidation. sUSDe liquidity seems to be seven days. Therefore, it is hard to say which one is truly more liquid.