Open letter to “Will the real stablecoin please stand up?” authors

Open letter to “Will the real stablecoin please stand up?” authors

The BIS issued a paper called “Will the real stablecoin please stand up?” claiming that no stablecoins has kept its peg (“not one of them has been able to maintain parity with its peg at all times”) and that there is “no guarantee that stablecoin issuers could redeem users’ stablecoins in full and on demand”. Here is an answer. Thanks to Adrien for reviewing.

Dear Anneke, Marc, Ilaria and Tara,

I read your last BIS paper “Will the real stablecoin please stand up?” with interest. You made some bold claims on the inability of stablecoins to keep their peg and their ability to be redeemed.

Let’s first address the obvious point where we agree. Some stablecoins are at serious risk and all could be improved. It is, after all, a nascent industry less than a few years old. Outright frauds such as Terra – insolvent by design (as I showed here before the crash) – are and should be pursued with the full force of the law for the prevarication they make to users and regulators about their solvency. One could only hope that regulators, which should be the adults in the room, help the public navigate and discern what is safe and what is not.

So far, regulators do not have a stellar record. Not only was Terra allowed to pursue its fraudulent scheme unpunished and unchallenged, regulators have been adamant about shutting down legitimate and well-formed stablecoins instead. For example, the NYDFS shutting down BUSD, the SEC attacking PYUSD and your paper putting USDT and USDC in the same bucket. This behavior leads to safer and more regulated stablecoins to decline and encourages proactive intransparency such as the case with USDT.

Crypto-backed stablecoins are by construction the opposite of opaque

You state “the majority of crypto-backed stablecoins are opaque on the size and breakdown of their reserves”. This is quite surprising. How can something that is publicly on-chain and independently verifiable be considered opaque? The whole balance sheet is there, on every blockchain node, updated in real-time, for all to see. At Steakhouse Financial, we maintain a query that shows the full balance sheet of MakerDAO (the issuer of DAI which is the main stablecoin in that category) on a daily granularity. The accounting system is fully open source for all to comment on and can be reconciled down to the on-chain transaction level. Everything is real-time and open. This is orders of magnitude more transparent than any traditional bank and actually improves macro prudential regulatory outcomes by providing users with transparent oversight into the backing of their stablecoins, rather than on a quarterly basis that banks such as Credit Suisse, Signature, Citizens or Silicon Valley Bank would have provided. Moreover, you can find third parties issuing their own analysis like Makerburn and DAIstats. Other stablecoins, like agEUR and Frax are also presenting their balance sheet on their website. While we can discuss the safety of crypto-backed stablecoins design, the transparency benefit over traditional finance is very obvious. Or so I thought. How can you see it opaque?

Secondary market data shouldn’t be relied on to analyze a stablecoin peg

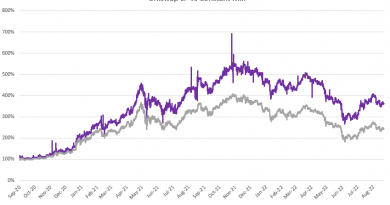

Your paper focuses on the use of secondary market data to show that stablecoins aren’t keeping their peg. Leaving aside the methodological problems of using CoinGecko data, which are ignored completely, the fundamental premise is based on a common error which is easy to understand. Unfortunately none of the analysis is relevant to the point that is being made. The fact that stablecoins, contrary to bank deposits, are traded all-day round on all sorts of exotic venues creates this error. But one should not see this additional freedom as an issue.

Every serious stablecoin (or bank deposit for that matter) has a primary market which is usually, but not only,the issuer. For instance, USDC can be obtained and redeemed at both Circle and Coinbase. In those places, there is absolutely no evidence that the peg was broken at any point in time. Even in March 2023 during a depeg episode, 1 USDC has always been redeemable at par in both primary venues in a timely fashion. What relevance is your analysis, then, to claims about stability or solvency? They might be relevant in an analysis about market efficiency or market perceptions about stablecoins but this path is left completely untrodden.

The USDC terms of services are quite clear that no guarantee is made on external platforms.

Moreover, if we apply the same argument you made on stablecoin to “real” money, we would come to the conclusion that TradFi no longer has singleness of money. Let me explain.

Firstly, Scottish banknotes are a great example of TradFi stablecoins. While one could believe that 1 Scottish pound never fails the peg, anecdotal evidence shows that they have a tendency to depeg in real-life (by no less than 33% in this example). No serious economist would take a trade in Krakow to estimate the value of a banknote. Yet, it is exactly what the article is doing. Imagine if we used airport currency exchanges actual trades to quote official FX rates. Who would do such a thing?

Secondly, in a less exotic and more crypto-native example, we can use the EUROe stablecoin. EUROe is also e-money and supervised by the Finnish Financial Supervisory Authority. Therefore, it is money, and ends up in the overnight deposit section in ECB monetary stats, the same level as any bank deposit.

If we look at CoinGecko, one could assume that it is unable to keep its peg oscillating from 0.97€ to 1.01€. Yet, again, I really doubt anyone has evidence that the peg was broken at the issuer.

There are plenty of other factors that can be cited to discard usage of secondary market data. Even within a blockchain, we can have two or more prices for the same stablecoin on different venues. Nothing prevents people from not using the worst price, the markets are nascent and not well organized yet. Moreover, stablecoin are usually paired with crypto-currencies that are volatile and for which the price at one point is already quite fuzzy. Yet to derive the price of the stablecoin, one needs the price of the cryptocurrency. The following capture from CoinGecko (that you use as data source for your analysis) shows the price of DAI on some recently used Dexes on Ethereum. All four are used to derive the final price.

I hope those arguments are convincing enough that secondary market prices aren’t great for defining a depeg. I’m not saying they have no value. A serious stablecoin issuer should be concerned about secondary market prices. But by itself it has absolutely no bearing on the contractual peg.

Redeemability is actually enforced by bank supervisors

Let’s move to primary markets, specifically your assertion that “no guarantee that stablecoin issuers could redeem users’ stablecoins in full and on demand”. The reality is that regulators around the world are supervising some stablecoins. It is concerning that the BIS staff is disregarding their seriousness or authority with such ease.

Indeed, in the US, the NYDFS is supervising Paxos (BUSD, USDP and PYUSD) and Gemini (GUSD). As noted in their public letter, they impose and enforce strict conditions of backing and redeemability.

- “The stablecoin must be fully backed by a Reserve of assets” (segregated and limited)

- “any lawful holder of the stablecoin a right to redeem units of the stablecoin from the Issuer in a timely fashion at par”

In Europe, EURe and EUROe are e-money and supervised by regulators (respectively the Central Bank of Iceland and the Finnish Financial Supervisory Authority) under Directive 2009/110/EC and will fall under MiCA. Those regulations have similar conditions of sound backing and redemption.

I’m no legal expert so I can’t say if supervision and the power over the supervised involves any accountability or guarantee. But if the public can no longer trust their regulators’ supervision, guarantor the financial system, what would be a good guarantee instead?

Concluding

Your last paragraph calls for complementary private and public effort to compete against stablecoins (as I understand that stablecoins are neither in the existing payment infrastructure nor CBDC). I hope this letter shows you that stablecoins are actually an improvement and that “real stablecoins” exist. I hope we could work together, the private and the public sector, to improve the understanding of stablecoins, improving their designs, helping the public to understand the technology and draft regulations that are in the interest of the public.

Should you be open to more diversity of opinion, I’m more than happy to help the BIS staff to learn more about the intricacies of stablecoins and produce a research report that actually and accurately delved into the question at the heart of your original paper. Steakhouse Financial is the leading expert on DeFi stablecoin and we are here to help. Our mission is to build open and transparent finance.