Singleness of money in crypto-banking

If a term is quite fashionable in central bank circles those days, it is the singleness of money. BIS papers and ECB officials are making the case that central bank money is needed to achieve the singleness of money. We will investigate the argument that no CDBC is actually needed to achieve singleness of money.

The setup

We will follow the conventions laid out in Accounting primer for crypto-banks. The underlying problem is one of liquidity in crypto-bank so you can also refer to the article Stablecoin design — Liquidity in addition of Crypto-Banking 101.

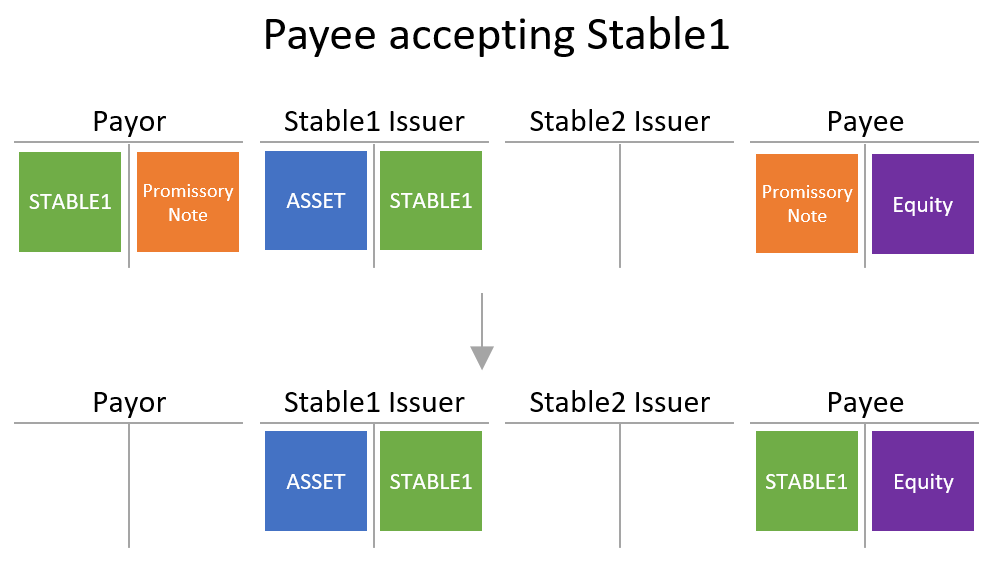

We will consider a environment where a Payee hold a Promissory Note on a Payor which has matured. The Payor hold some STABLE1 issued by Stable1 Issuer. Payee prefer to hold STABLE2 issued by Stable2 Issuer. Both STABLE1 and STABLE2 are based on the same unit of account.

To start with a simple case, let’s assume that Payee is fine to be paid in STABLE1. This would be a transfer of STABLE1 tokens from the Payor to the Payee which would extinguish the Promissory Note.

(On a side note, the Promissory Note could well be an NFT issued by the Payor and one could imagine smart contract functionalities on top of it)

Now, let’s explore way for Payee to get STABLE2 instead of STABLE1. We will limit the analysis and the burden of finding a solution on Stable1 Issuer and Stable2 Issuer.

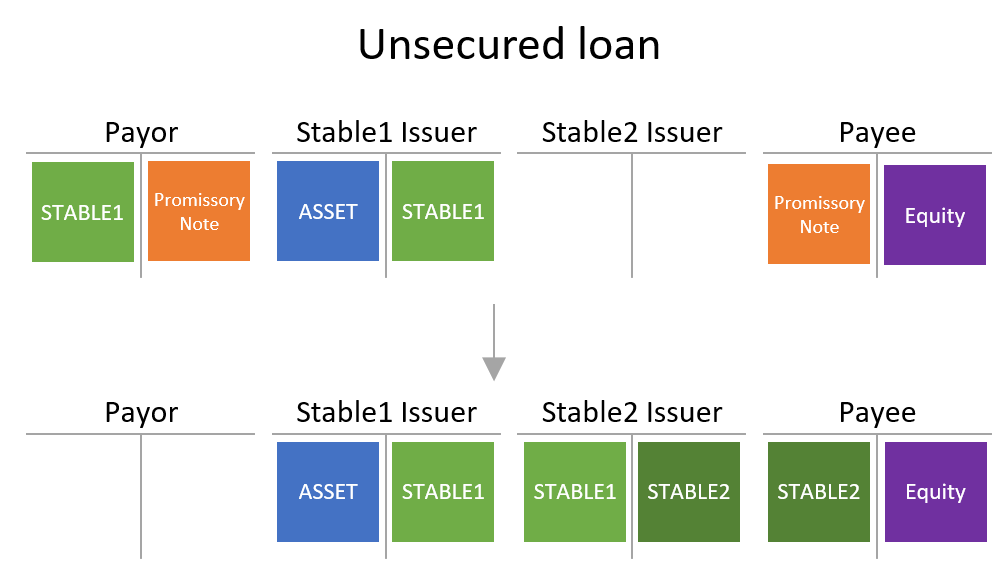

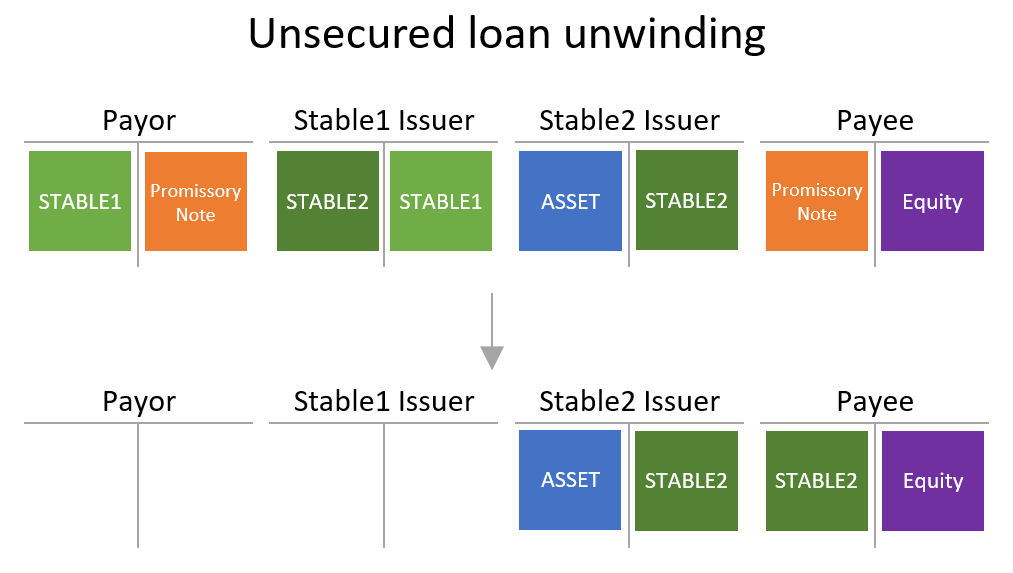

Unsecured loan

The first option would be for the Stable2 Issuer to provide a facility where anyone can deposit STABLE1 to mint STABLE2. Therefore, the Payor could send STABLE1, which would then be converted into STABLE2 for the Payee. In terms of balance sheet accounting, the STABLE1 would be deposited on the Stable2 Issuer’s balance sheet, which would then issue an equivalent amount of STABLE2 that would be added to the Payee’s assets. The entire operation would be atomic, ensuring that the Payor never bears any STABLE2 exposure, nor would the Payee bear any STABLE1 exposure.

Such a system already exist in DeFi and is referred as a Price Stability Module (PSM). For instance, MakerDAO maintains USDC, USDP and GUSD PSMs where anyone can deposit those stablecoins to mint DAI.

The question remains: why would the Stable2 Issuer want exposure to STABLE1? The Stable1 Issuer could incentivize the Stable2 Issuer by offering an interest rate on STABLE1, either at the standard rate available to everyone or a specific preferential rate. The exposure to STABLE1 would be kept within certain limits to mitigate credit risk. It should also be clear that unsecured loan doesn’t mean there is no collateral. It could, and should, be backed by the whole Stable1 Issuer balance sheet incorporating some smart contract rules enforcing overcollateralization and soundness. But such collateral is not specific and is not in escrow in a Stable2 Issuer smart contract.

With such an arrangement, once a PSM starts to fill, the opposite pattern could also work. Assuming that the Stable1 Issuer already has exposure to STABLE2 (with STABLE2 as an asset), it could then decrease this exposure to allow STABLE1 to be converted into STABLE2. In this case, the Stable2 Issuer would not be impacted. This situation is evident in the case of MakerDAO, where anyone can convert 100M of DAI (STABLE1) to USDC, GUSD, or USDP (STABLE2).

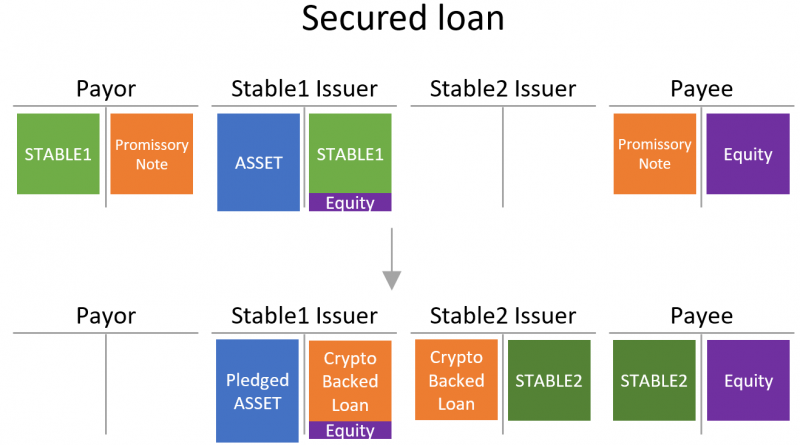

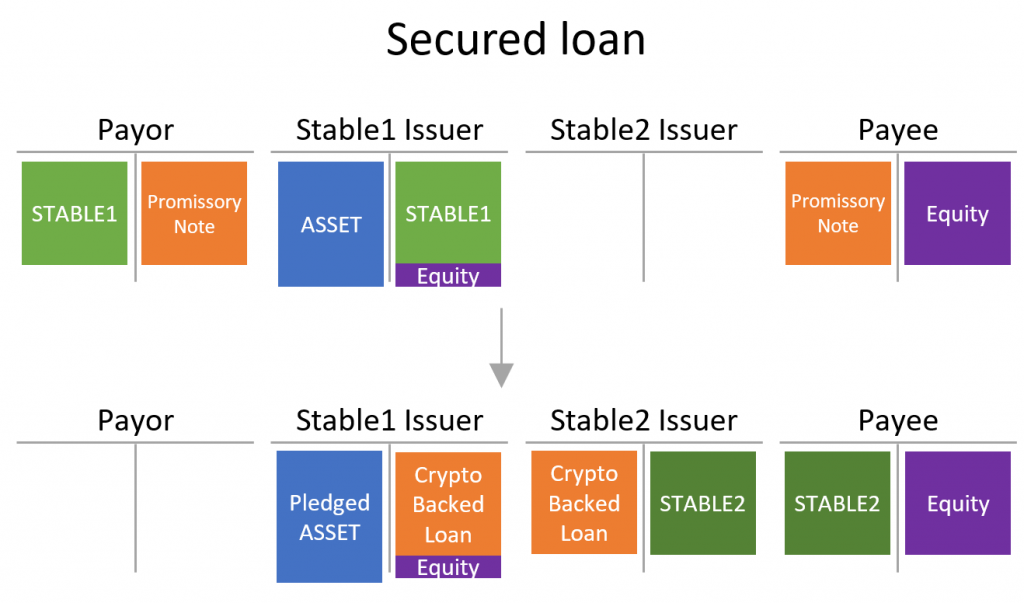

Secured loan

A secured loan requires a haircut on the collateral (or overcollateralization), therefore we also add some equity to the Stable1 Issuer’s balance sheet, making the value of the ASSET larger than the transferred STABLE1. The term ASSET is generic; it could be a CBDC, a T-bill token, or a cryptocurrency. As with any secured loan, it’s crucial to have a deep and liquid market for the token.

To get some STABLE2, Stable1 Issuer will enter in a crypto-backed loan with Stable2 Issuer by pledging the ASSET (within a smart contract but retaining the ownership).

Conceptually, the crypto-backed loan could be facilitated through a third-party lending protocol that accepts ASSET as collateral and has STABLE2 liquidity. The collateral can also be rehypothecated. Both solutions, however, would add a layer of complexity to the process.

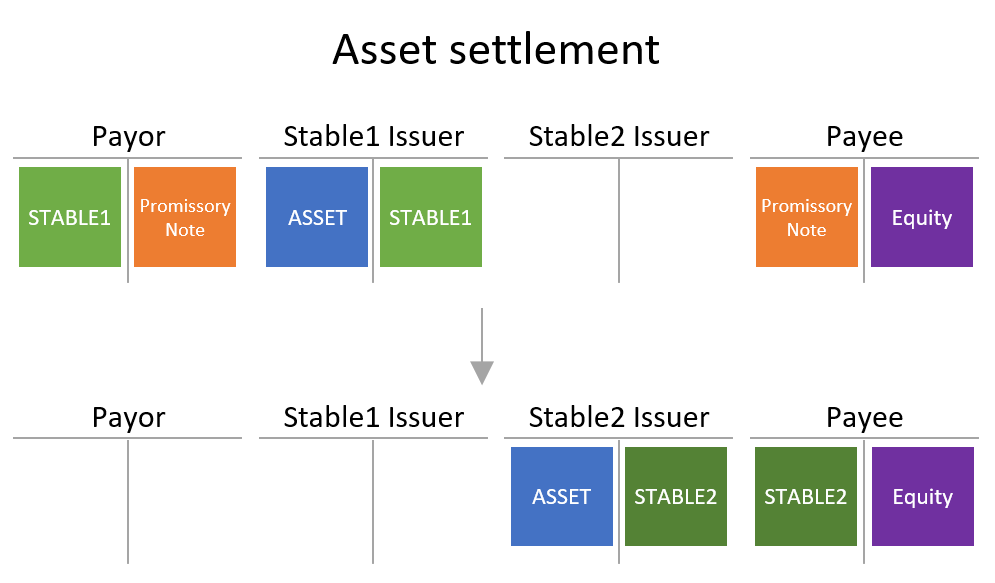

Asset settlement

Another option is to settle the conversion between STABLE1 and STABLE2 using ASSET. While ASSET could be anything, it assumes that the Stable2 Issuer would accept it in order to mint STABLE2.

The limitation of this method is that asset pricing isn’t stable with respect to the unit of account. Even a T-Bill’s price will fluctuate and have a bid/ask spread. Consequently, the Stable2 Issuer would purchase the asset at some form of discount, leading to a mark-to-market loss for the Stable1 Issuer.

The asset settlement method would function well with a CBDC. While it’s far from a perfect substitute, USDC currently fills this role in DeFi. It is conceivable that an on-chain, T-Bills-backed stablecoin could be a superior alternative.

Conclusion

As we have seen, getting to the singleness of money is just a matter of using the different solutions laid out here (and others as well like the ClearingDAO).

Presently, fiat-backed stablecoins are prohibited from utilizing these methods. For DeFi stablecoins, the field is still in its infancy, and the concept of singleness of money is not yet viewed as a priority. Additionally, a key principle of crypto is freedom, meaning there will always be some avant-garde chains or decentralized exchanges where singleness of money will not be achieved. This isn’t a problem per se. The traditional financial (TradFi) money system only provides singleness of money in narrow primary markets. The facts that secondary markets and innovation are forbidden can hardly be advantageous.