The history of a DAI at par value

What can we learn from it?

Summary

- The price stability of DAI was expected to be managed by rate settings and speculative arbitrage

- This didn’t work in the aftermath of Black Thursday when DAI liquidity was needed to close borrowing positions, nor during DeFi Summer

- A risk-free arbitrage was introduced with a low Collateral Ratio USDC-A and finally the PSM

- The balance sheet of MakerDAO can now be expanded by DAI demand and no longer only by DAI supply

- Fees (tin) on the Price Stability Module (PSM) were removed on November 10th 2021. Now 1 USDC = 1 DAI = 1 USDP

- No significant change in USDC exposure was attributable to this change

- Decentralized trading volumes of the DAI/USDC pair increased as the PSM volume was additive (but might be due to the Uniswap v3 1bps pool)

- Impact for DeFi users is not significant as only a minority of traders use the PSM. Uniswap V3 1bps tranche was a more significant improvement. This might be due to high gas costs of the PSM and user preference for Uniswap.

- Crypto-lending is highly volatile which impact the balance sheet structure

- Real-World Assets could reduce balance sheet structure volatility

Introduction

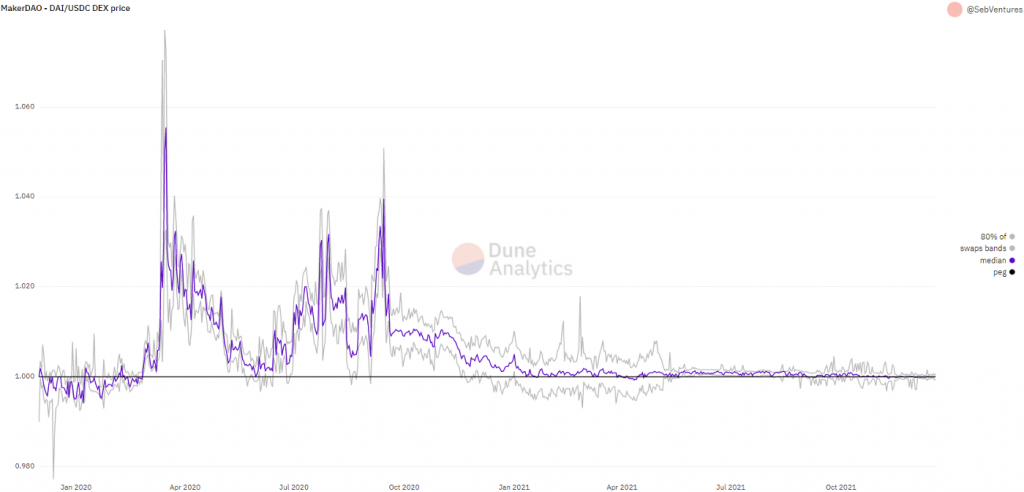

MakerDAO introduced DAI with a target price of 1 US Dollar. As we will see this quest for the peg took years. You can see below the evolution of the price of DAI against USDC since the end of 2019.

We will see how MakerDAO first relied on interest rate setting to balance the supply and the demand of DAI, then introduced a USDC-based vault to provide an arbitrage (speculative at first then risk-free). Finally, the Price Stability Module (PSM) was the biggest innovation of MakerDAO at the end of 2020. It solved the peg issue that MakerDAO was facing since DeFi Summer and replaced the stablecoins vaults that were coming to a limit.

We have explored previously that stablecoin issuers should fit two main constraints: solvency and liquidity and this paper is about the liquidity part. It was also discussed at length in Stablecoin design — Liquidity. We have later discussed a solution to fix the par value of stablecoins.

Some might challenge the need for liquidity as DAI is not contractually redeemable for anything until an Emergency Shutdown. One historical example is the Bank of Amsterdam that moved to a fiat standard in 1683 but used open market operations to keep the price of the bank guilder within a range (see How Amsterdam Got Fiat Money).

This paper starts with a historical analysis of the DAI peg by analyzing changes to address the problems at hand. We focus particularly on the balance sheet impacts of the implemented solutions. Then, we discuss some ideas before concluding.

Historical analysis of the peg

Early days

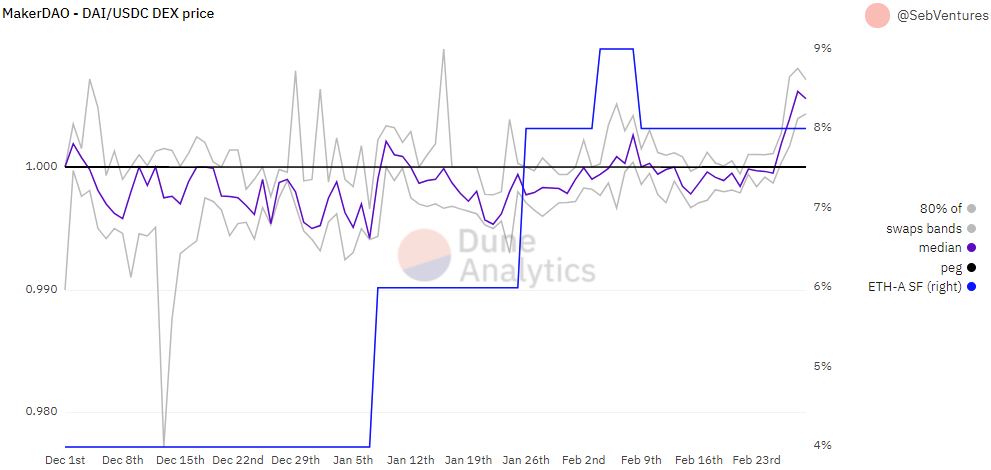

The early days of DAI (MCD version, but the SAI version was quite similar) were quite bumpy. DAI traded usually below the peg and that was solved by raising the interest rate (Stability Fees) on the Eth Vault (ETH-A SF). There was too much DAI supply and not enough DAI demand. You can see that each ETH-A SF raise was impacting the DAI price (it is unclear what caused the spike at the end of February). It should be noted that, at the time, the DAI Saving Rate, the DSR, (the ability for DAI holders to get an interest) was moved in line with ETH-A SF. They both achieve the same goal (increasing the price of DAI) but while increasing ETH-A is decreasing DAI supply (borrow), increasing the DSR increase the DAI demand (to get the yield).

This shows that dealing with ETH-A SF and the DSR were kind of effective to keep the DAI price close to the peg. Effectiveness should nevertheless be measured by the y-axis scale.

Black Thursday

On March 12th 2020, Black Thursday unfolded. Crypto prices plummeted (ETH fell by 43%) and it was the worst day for MakerDAO which led to $4.5M of underfunding and loss of collateral from borrowers due to a zero-bid issue. You can read a comprehensive Glassnode account here.

What matters for this analysis is that the price of DAI jumped and stayed at an elevated level. This would be strange for any TradFi practitioner. If DAI is a liability of MakerDAO, how could its price increase when the whole protocol becomes insolvent? The solution to this riddle is that borrowers need those DAI to close their vault and get their collateral back. When everyone wanted to close their vaults, DAI was a scarce asset as the debt could go only be paid in DAI.

During those events, USDC-A and USDC-B vaults were added to provide a backstop and limit the price of DAI (the limit being $1.25 at the time).

DeFi Summer

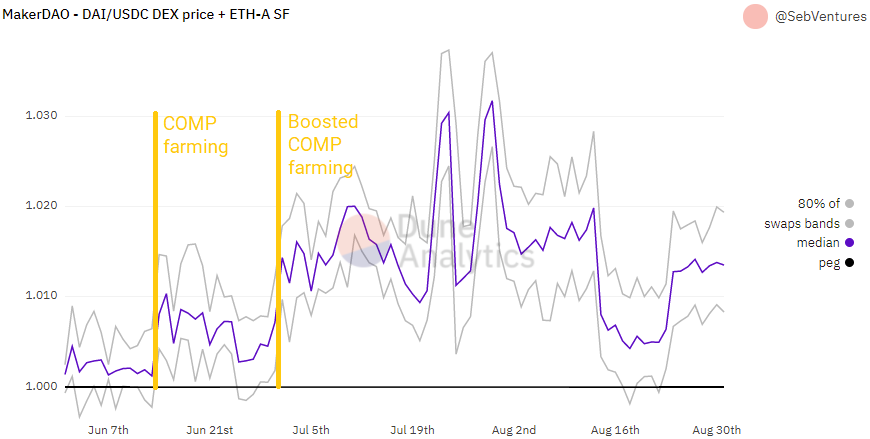

DeFi Summer is assumed to have started with Compound providing liquidity farming. On June 15th, 2020, Compound started rewarding its users. On July 2nd 2020, Compound changed the rewards and it impacted the price of DAI as was forecasted by Cyrus.

Quite quickly, the world was amazed that there was now more DAI on Compound than issued by MakerDAO (due to recursive farming).

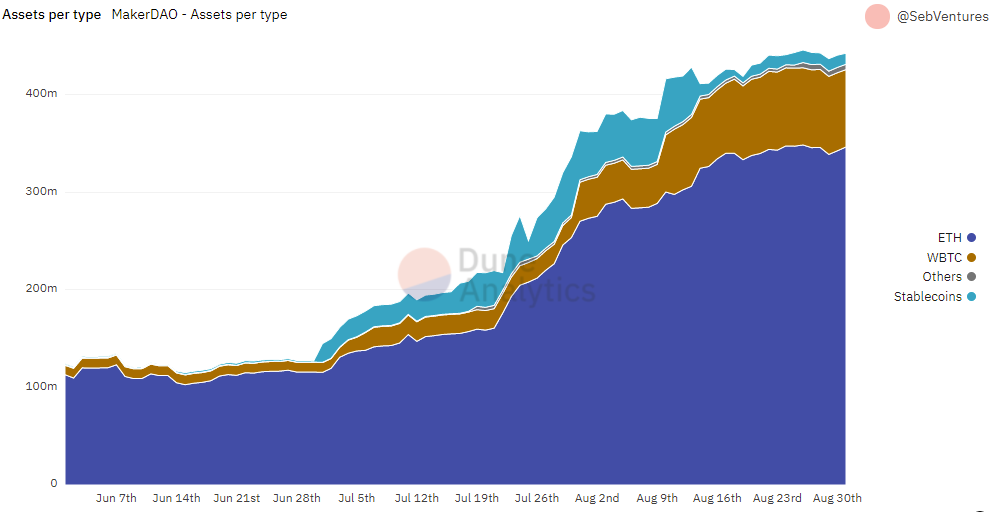

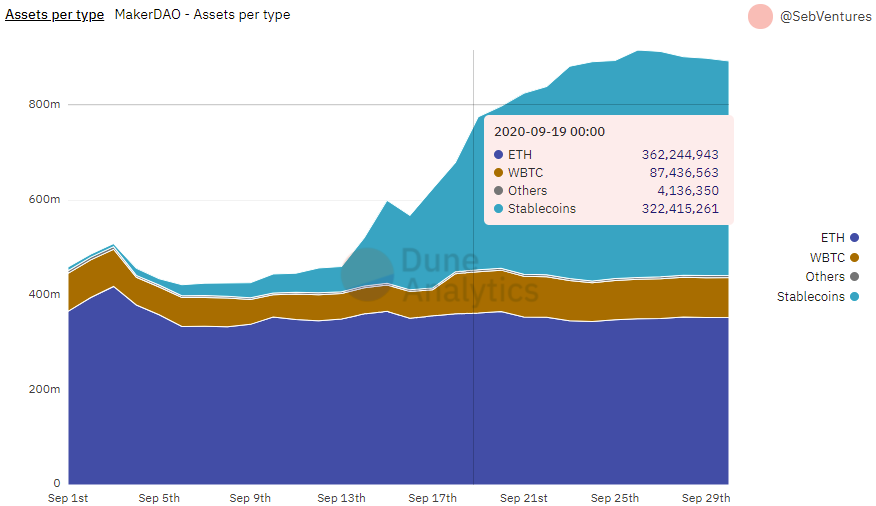

The balance sheet of MakerDAO expanded to provide those DAI but not as fast as needed. As you can see below, some arbitrageurs were using the USDC-A vault when the price of DAI was volatile. Nevertheless, it was a speculative arbitrage and not a risk-free arbitrage, therefore the market anchored an ever-increasing “base” value of DAI.

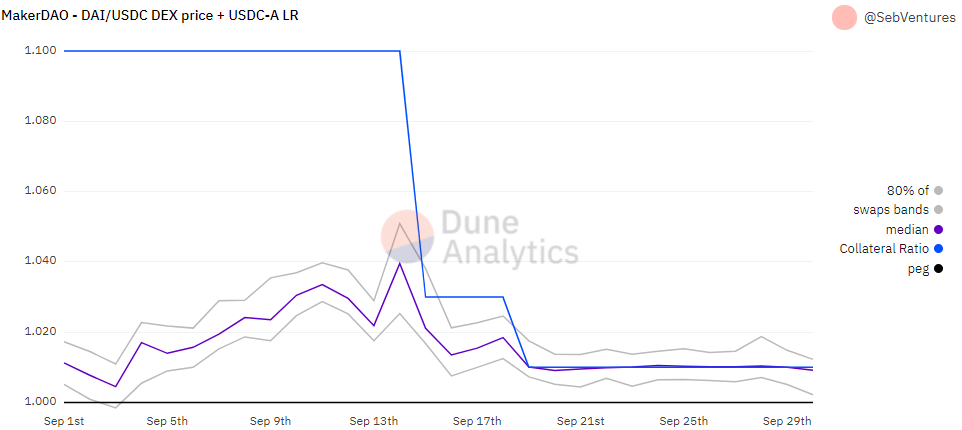

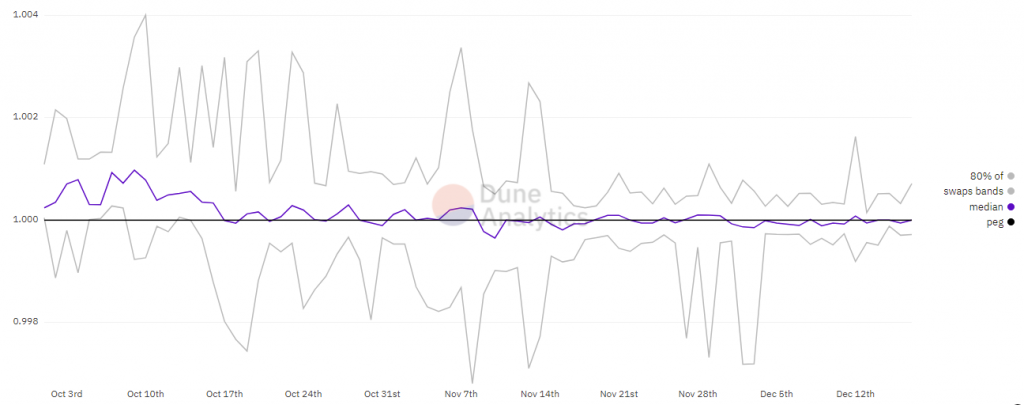

Lowering the stablecoin vault liquidation ratio

On September, 15th 2020, the collateral ratio for USDC-A was decreased from 110% to 103% (it was 125% initially a few months ago). Quickly after, on September, 19th, liquidation ratios for USDC-A, GUSD-A, PAX-A and TUSD-A were decreased to 101%. Those actions created a risk-free arbitrage as the DAI price was above 1.03 before the first change and above 1.01 before the second change.

This action immediately provided a median transaction price cap at 1.01 (the bands being the 30bps of Uniswap fees). Nevertheless, with a Stability Fee of those vaults (4%) and no liquidation, the solution was not sustainable. As of writing, there is still $335M locked in those vaults. With a 1% Stability Fee, some vaults are becoming undercollateralized (example). A Stability Fee is present to render all those vaults liquidable in the future, but it generates some undue revenues (lending revenues that will be matched by a liquidation loss at some point). It is not impactful as long as it gets managed within a decent timeline (i.e. within 12 months).

On the MakerDAO balance sheet, we saw a huge inflow of USDC-backed loans resulting in the doubling of the balance sheet. The effect started a bit before each executive implementation as people front-runned the opportunity.

Introducing the PSM

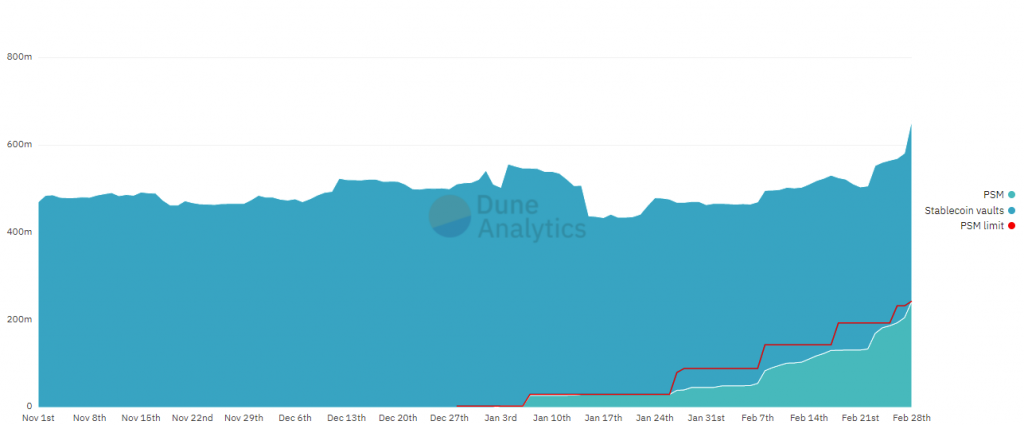

On December 24th, 2020, the Price Stability Module (PSM or MIP29) was introduced. The PSM allows anyone to deposit USDC to get DAI and the opposite (which is limited by the amount of USDC in the PSM). The discussion on the need for a PSM started in early July. The PSM is controlled by two main parameters tin and tout corresponding to the fees that are taken for allowing the swap.

The tin parameter started at 1% (same effect as USDC-A with a 101% LR) and was reduced linearly to 0.1% over 7 days. The Debt Ceiling (DC) was limited to 3M, then 30M during which the facility it was limiting the usage. It is only after January 27th that the PSM DC was no longer a limiting factor.

As you can see below, moving the risk-free arbitrage from 1% to 0.1% didn’t have any impact on the stablecoin exposure. Some USDC-A exposure was migrated to PSM-USDC-A, but overall the stablecoin exposure was quite stable.

The PSM still improved the pricing of DAI that was closer to $1. Nevertheless, the trend started before the introduction of the PSM (indicated by the fact that the median price was quite below the risk-free arbitrage of $1.01).

Hardening the peg: 1 DAI = 1 USDC = 1 USDP

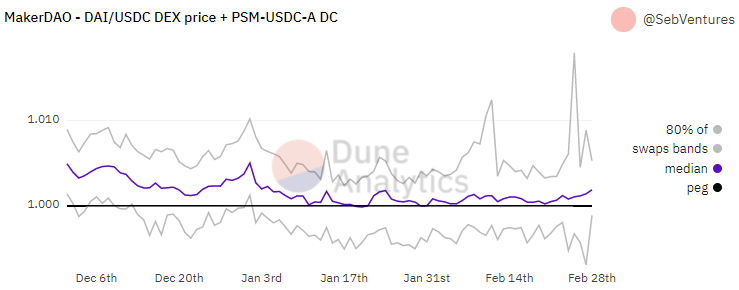

On November, 10th 2021, the fees (tin) on the USDC and USDP PSM were removed after a signal request. The intent was to move toward a space where all stablecoin are tradable at par by anchoring to a risk-free arbitrage.

One of the concerns was that such a move would attract a significant amount of USDC. As for the move from 1% to 0.1% in the PSM, it wasn’t the case and no significant impact could be found in the balance sheet evolution.

.

The price of DAI wasn’t impacted directly either. It has been around par since October 17th.

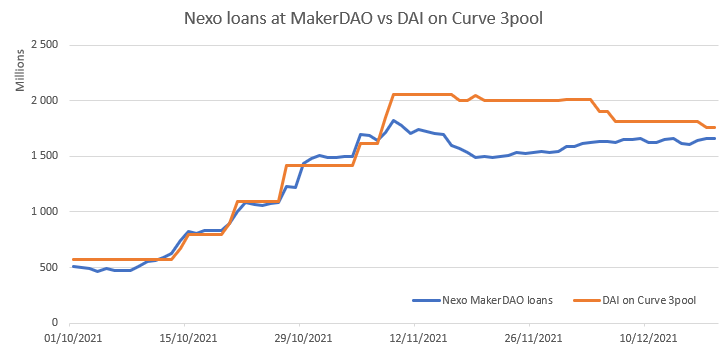

This later date is explained by borrower behavior. As you can see below there is a clear correlation between the increase in Nexo loan exposure at MakerDAO (see MakerDAO Borrower Concentration Analysis) and the amount of DAI on Curve. This makes sense as Nexo’s behavior is to sell the DAI it borrows. While correlation is not causation, it seems to be strong enough evidence. This also explains why the PSM was losing USDC before the fees change.

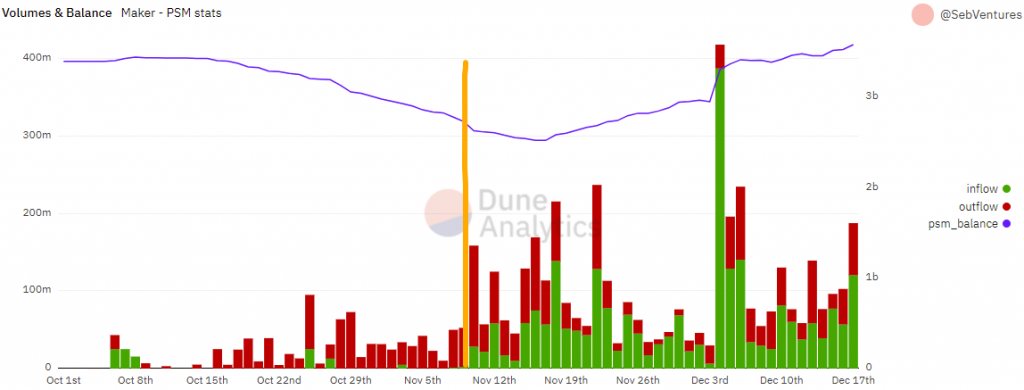

Therefore, the main impact we can attribute to the suppression of fees is an increase in PSM volume. Since fees are removed, there are inflows and outflows every day and volumes are far above history.

The impact in trading volume can be seen on DAI/USDC pair trading per decentralized exchanges. Curve was the main place before the PSM but this immediately moved to the PSM after fees were removed. Quickly after, Uniswap v3 added the DAI/USDC 1bps pair and took some market shares as well.

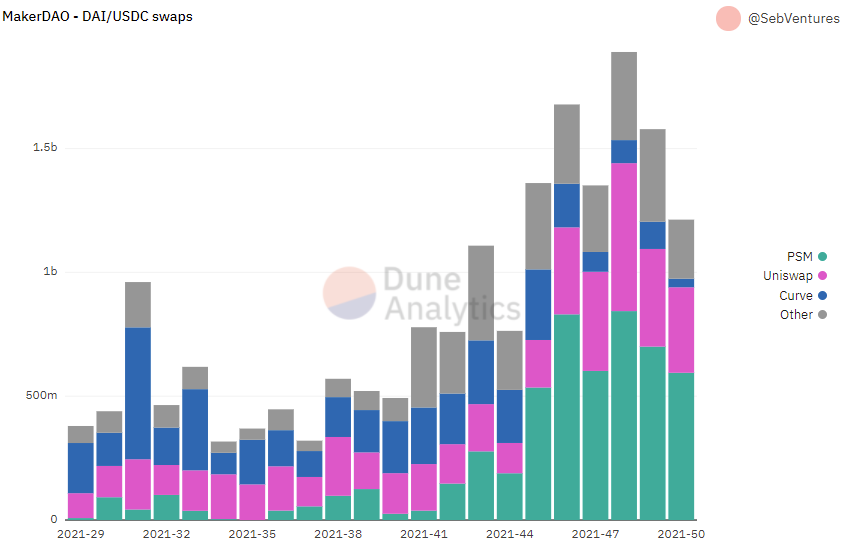

It is also interesting to note that the PSM volume seems to be an addition to the preexisting volume (PSM without fees was introduced week 45 and the DAI/USDC 1bps Uniswap pools got significant liquidity on week 46.

Finally, the chart below shows the daily spread over swaps done on Dex. One can see that 50% of the transactions are done within the Uniswap fees spread (20bps until November, 17 when the 1bps pool got $7M of liquidity creating a spread of 2bps). While removing the fees improved the number of transactions through the PSM, it’s still below 10% of the transactions (but with a higher amount per transaction compared to other venues).

Discussion

After showing the history that brings us to a point where DAI is now traded at its par value, we will now discuss some learning and ideas that could inform MakerDAO community decisions in the future.

Rates and speculative arbitrage are not enough

As we have seen, initially, rate settings (both on the lending side through Stability Fees and on the DAI Saving Rate) were the only tools to guide the price of DAI toward the peg. Before Black Thursday, the system worked quite well and it could be argued that with enough liquidity available (as we have today with billions on Curve), MakerDAO would have been able to achieve a strong peg.

This stopped working even with Stability Fees at 0% and DAI Saving Rate at 0%. The DAI demand was above DAI supply leading to an adjustment upward in price. First, it was due to the need of DAI to close borrowing positions (which the MakerDAO whitepaper interestingly labeled as a “benefit”). Then DeFi Summer increased the DAI demand for liquidity farming. We are now at a stage where stablecoins are a more useful use case for some people than crypto-speculation.

The USDC-A vault facility was introduced to provide tools for speculative arbitrage (removing the fluctuation risk of the underlying asset). Sadly, there weren’t enough arbitrageurs to fix the peg. Moreover, as the underlying problem was not solved (DAI demand > DAI supply), the arbitrager stopped taking risks.

The problem was fixed only after a risk-free arbitrage was introduced and the balance sheet was allowed to expand due to DAI demand.

Ensuring the peg is an impactful balance sheet decision

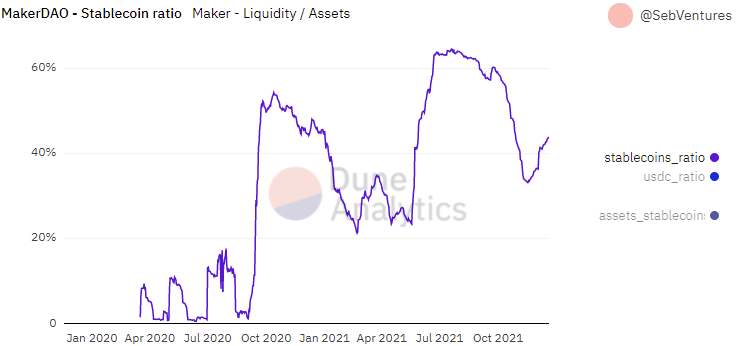

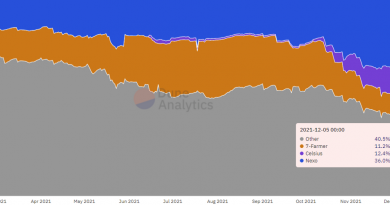

Currently, MakerDAO is providing a tight peg with regulated stablecoin, the main one being USDC. As we can see in the chart below, fluctuation of stablecoin reserves as a ratio of the balance sheet size is quite important with liquidity reserves taking up to ⅔ of the balance sheet. There were two 30%+ fluctuations in 2021. The liquidity part of the balance sheet is important and can fluctuate wildly.

Crypto-lending require a high level of liquidity reserves

The chart below illustrates that fluctuation in terms of stablecoin/balance sheet was mainly driven by DAI supply (users taking loans) than DAI demand. While DAI demand was almost a straight line in 2021, DAI supply fluctuated significantly and was correlated with crypto-market sentiment.

Therefore, the type of assets (other than liquidity reserves) in the balance sheet has an impact on the liquidity reserves needed. As we have seen earlier, the liquidity reserves were quite reduced when Nexo started to aggressively mint. How important is it for our borrower to be able to mint additional DAI at scale without hurting the peg? The answer to this question is important to understand the minimum liquidity buffer to keep.

Obviously, the historical “low” volatility of DAI demand shouldn’t be taken for granted either as regulation is unpredictable and stablecoin competition is growing.

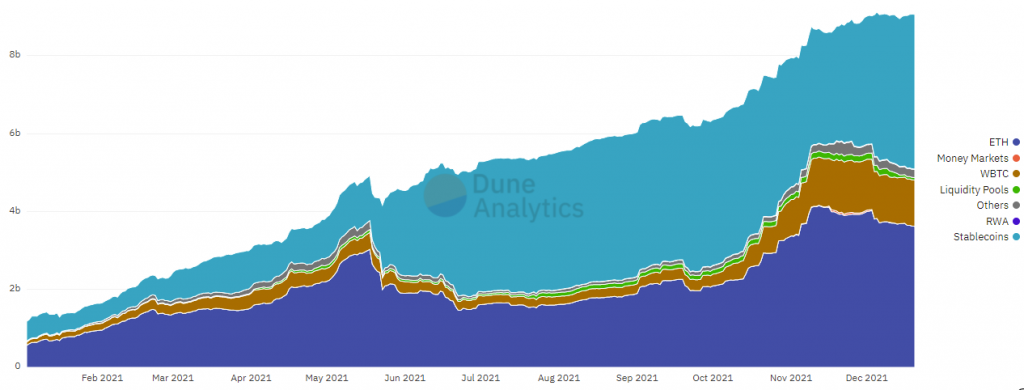

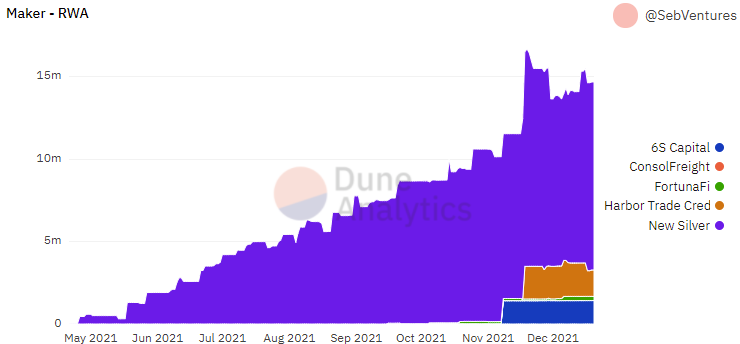

Impact of RWA and money market lending

Started only this year and still quite small, Real-World Asset lending (RWA) seems so far unaffected by crypto-volatility. Adding RWA to the asset mix will probably stabilize the need for liquidity. It should be noted that RWA will more likely be less liquid, therefore bringing their own liquidity considerations

Even more recent was the money market initiative (Direct Deposit DAI Module, D3M or MIP50). This module adds some DAI on Aave when the DAI borrow rate there is above a given threshold. As Aave is crypto-backed lending, it shows the same volatility of borrowing demand as MakerDAO. Therefore, rates are low when speculative demand is low.

It can nevertheless act as a buffer in case of strong borrowing demand. Indeed, while Maker is engaged to keep interest rate fluctuations low on its platform, it didn’t make such a promise for its lending on Aave. In case of liquidity risk, MakerDAO could stop its Aave DAI lending without much commercial consequence. In such a framework, it could make sense to provide a lower borrow rate on Aave but be upfront that Aave borrowers don’t have the same rate protection that MakerDAO borrowers enjoy.

Conclusion

As we have seen through this paper, achieving the par value of DAI (1 DAI = $1) took years in the making. It was designed to work with rate setting as the only policy tool. It quickly ran into the problem of not having enough borrowing demand to fulfill the need of DAI. Speculative arbitrage wasn’t enough as the credibility of MakerDAO to solve the peg issue decreased.

While the balance sheet expansion of MakerDAO was only possible due to borrowing needs (DAI supply), the PSM enabled the DAI demand side to alter the balance sheet as well. The PSM, therefore, represents the imbalance between DAI supply and DAI demand. The adjustment variable is no longer the price.

Going forward, we recognize that the current balance sheet structure of MakerDAO is fairly volatile as it is based mainly on crypto-speculation. The RWA and money markets initiatives are great steps towards reducing the volatility due to crypto-markets.