Crypto-banking differences with traditional and shadow banking

Do we need fractional or full-reserve banking in crypto?

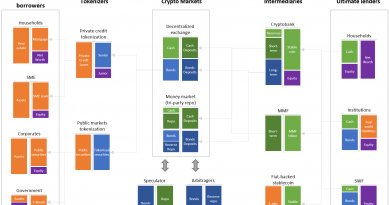

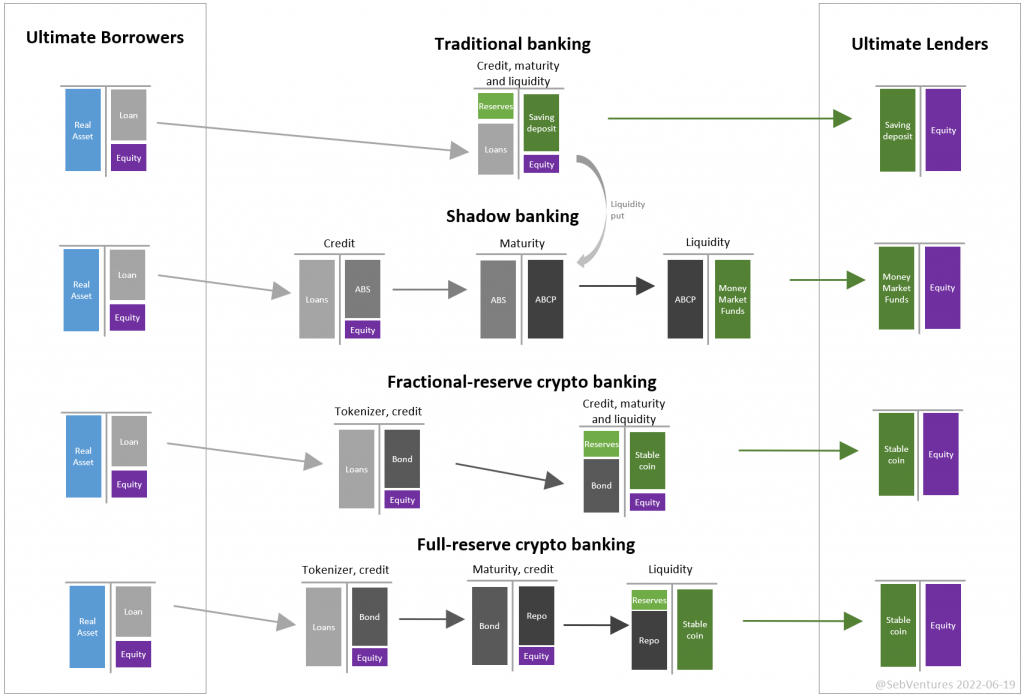

Banking is the alchemy of bridging ultimate lenders that want safety and liquidity to ultimate borrowers that want long dated maturities and are making risky bets. It is both an art as a science as achieving this goal is impossible and bring fragility. Yet, it is needed to create grow for our economies. Using learnings from the real-world, we will think on this can inform us for crypto-banking.

Real-world banking

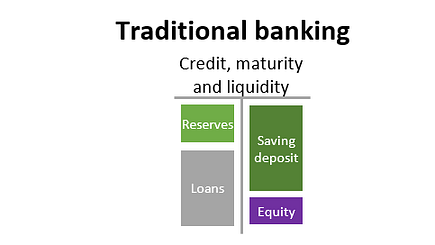

Traditional banking is a model used for centuries. It is one intermediary that provides credit, maturity and liquidity transformation. The lender gets an on-demand saving deposit while the borrower get long term loan.

The mismatch between the two sides is bridged by adding some forms of credit enhancements (the equity of the bank) and a liquidity buffer (reserves). On top of that, we can have a central bank providing liquidity of last resort and a government insurance to provide trust.

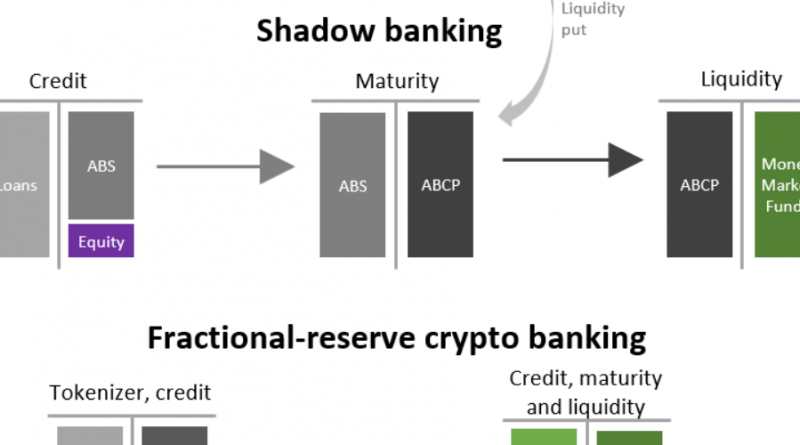

Due in part to the regulation on bank, a chunk of the lending/borrowing mismatch management was transferred to the so called Shadow Banking. The article Shadow Banking Economics and Policy is an excellent starting point. For this paper, suffice to say that shadow banking is splitting the transformations in subparts. Loans are bundled and sliced to provide many kind of credit risk profiles (ABS for Asset Backed Securities). Those are refinanced by short-term commercial paper (ABCP — Asset Backed Commercial Paper) with a bank providing a liquidity put as guarantee. Those ABCP are then pooled in Money Market Funds (MMF) as safe short-term investments. The MMF shares are considered as money-like instruments.

The Global Financial Crisis showed the fragility of Shadow Banking as complexity, mark-to-market valuations and lack of liquidity broke the system.

Enter crypto-banking

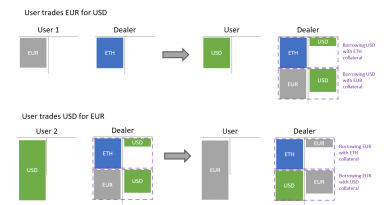

Crypto-banking is still young and it unclear how it will evolve. In DeFi (Decentralized Finance), the prime importance is given tokens (securitization), composability and liquidity. One can make the case that DeFi is inherently suited for market-based finance.

In such setup, a pool of private credits (loans) are pooled together to create securities/tokens. There can be many tranches for different risk-profiles. This is quite similar to the Shadow Banking system. The pooling and tokenization provide a market for such assets and help with price discovery. Being a tokenized assets with a price feed and liquid markets, it becomes a collateral that can be used for repo (composability). Therefore, one main difference with Shadow Banking is the size of such securitization. It should be big enough to have strong liquidity (i.e. billions at least).

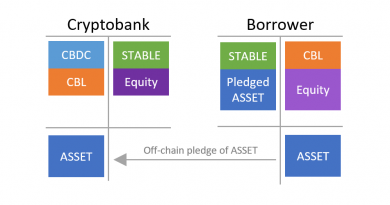

Initially, crypto-banks where involved in crypto-backed loans. Those are still private and illiquid credit even if quite secured and short-term. Nevertheless, evolution of the crypto-bank is towards market-based activities where assets are sourced and put on the balance sheet. Same as traditional banking, there is a credit enhancement (equity) and some liquidity buffer. This is the model I analyze in depth in Crypto-banking 101. DAI, FEI, FRAX, agEUR are based on such model.

Another view of crypto-banking is a more shadow banking approach. In such view, stablecoin are fully-reserved, i.e. backed only by cash or cash equivalent (like USDC, BUSD, …). To make the connection with the borrowers, stablecoin holders should leverage other protocols as showed below.

The tokenized is the same as already discussed. Then comes the maturity transformation. This would be done by using the existence of a liquid market for the bond to be able to repo it on a money market (e.g. Aave Euler , …) displayed on the right side (will come back to it soon). The bond maturity could be years while the repo is open term. As there is an haircut on the repo market, there is a need for equity which is adding a credit enhancement as well.

The money market, on the right, provides some liquidity transformation by keeping a buffer of liquidity and adjusting in real-time the interest rate on repo.

There is no liquidity put so the expected scenario in case of stress is interest rate going through the roof on the money market, value of the collateral being depressed and liquidations occurring.

If the market of such a bond is no longer liquid it will end up wiping the middle intermediary and accruing losses to the ultimate lender. Notice that such a loss is due to market illiquidity and doesn’t mean the loans are defaulting in the end.

This last item makes me feel fractional-reserve crypto-banking is a better alternative. It is still unclear how to address systemic issues like a generalized bank run. Using mark-to-market valuation in an illiquid market could trigger a crypto-bank insolvency (at least from accounting) and therefore a bank run.

Yet, at the same time, a fully market-based would provide a significant amount of collateral and required transparency. Maybe part of the answer is in the Option Clause like the one used by Royal Bank of Scotland during Free Banking Era?

Moreover, while we can self-regulate to be on the safe side in term of allocation (equity buffer, liquidity buffer), it is impossible to ensure liquidity in a market.

For those reasons, I believe fractional-reserve crypt-banking is the future. We take the best from traditional banking and shadow banking.