How the crypto-banking system could reduce systemic risk

This article shows that liquidity pools, a basic construct of DeFi could create a more robust financial system by improving assets liquidity and, in the same time, improving passive investors performance.

Liquidity as the systemic risk and the death of the dealers

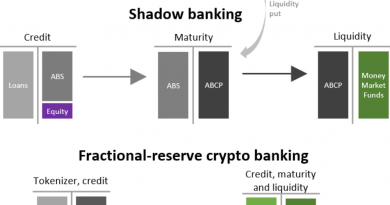

One issue during the Global Financial Crisis was the refinancing of long term debt instruments with short term funding. This is shadow banking. In case of stress, there is a liquidity crunch and the whole system stall. One option, proposed in The Money Problem, is to forbid non-regulated entities from issuing short-term, money-like, liabilities.

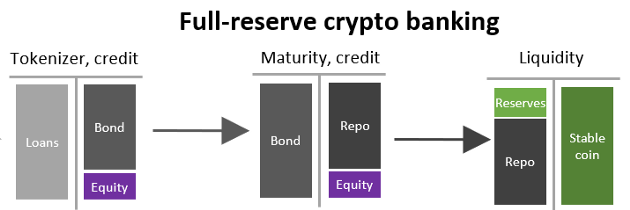

The Crypto-Banking System is no stranger to issuing short-term liabilities, from stablecoins to aggressive use of repurchase agreements (repo, i.e. secured short-term lending). If we zoom in on the full-reserve crypto banking part, there is a maturity transformation by funding longer maturity assets (e.g. bonds), by the mean of open repurchase agreements. We identified clearly that a key assumption was the “existence of a liquid market for the bond”.

Such a liquidity is needed to enable orderly liquidations. If $1B of bonds are repo with a 10% haircut (the overcollateralization), the system is safe, if, and only if, those bonds could be sell in a short period without moving the price by more than 10%. Otherwise, there will be a liquidation loss.

Concerns about the liquidity of markets for the bonds used as collateral led to increases in repo “haircuts”: the amount of collateral required for any given transaction. With declining asset values and increasing haircuts, the U.S. banking system was effectively insolvent for the first time since the Great Depression.

Gary Gortno and Andrew Metrick, Securitized Banking and the Run on Repo, 2009

Liquidity is a key driver for asset prices. The existence of abundant liquidity is, therefore, key for orderly markets.

Not only does the demand for liquidity move prices, but the breakdown of liquidity is one of the primary drivers of crashes, as well.

Richard Bookstaber, The End of Theory: Financial Crises, the Failure of Economics, and the Sweep of Human Interaction, 2017

In current markets, the liquidity is provided by dealers that are making markets. They leverage their balance sheet and provide a bid/ask spread so sellers don’t have to wait for a buyer and the opposite. Yet, while it works well in normal markets, it tends to fail in stressed market. Dealer reduced their risk in the 2013 sell-off and the reduction of dealer balance sheet capacity accounted for 25% of the sell-off during the Covid crash.

Other kind of market participants should obviously be incentivized to buy and asset when there is a price discrepancy due to market stress. In his article Asset Price Dynamics with Slow-Moving Capital, Darrell Duffie call those market participants “inattentive investors”. They tend to come too late to the party (after a liquidity crunch spiral is already in motion).

What if those inattentives investor could be active and get rewarded for it?

Crypto-banking and the abondance of liquidity

Significant research advocate for diversified and automatically rebalanced portfolios, like the Dragon Portfolio from Artemis or the All-Weather Portfolio. At the same time, we live in a rise of passive investing macro trend. Playing the market is no longer seen as better than just holding the market.

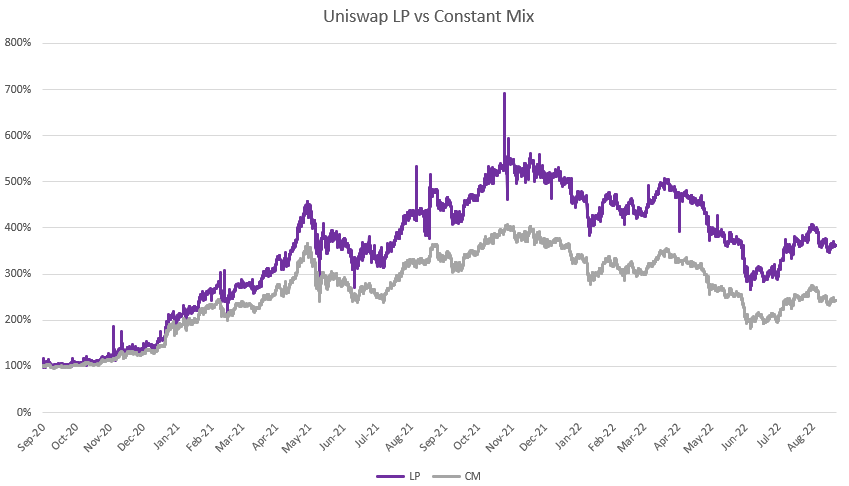

As displayed in the chart below, holding a 50% USDC / 50% ETH portfolio in a Liquidity Pool (LP) would have been granted a 50% overperformance versus balancing every hours (not taking in account cost). The providing of liquidity in Uniswap is akin to rebalancing by selling options (and collecting the premium) instead of rebalancing by market orders.

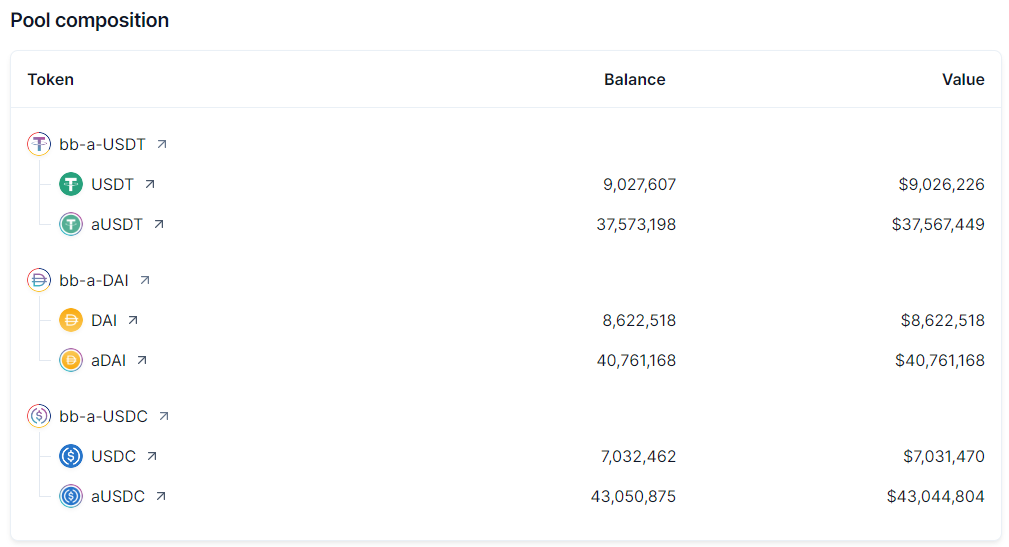

Moreover, performance and efficiency can again be improved by depositing the underlying assets of the Liqudiity Pool to a money market like Aave and Compound. While this was started with iearn Curve pool, it proved too gas intensive. The Balancer Boosted Aave USD is a more recent iteration on the concept (keeping some assets uninvested for easier trading).

It is still early days on research in this area. For one, we are still remote from the days where a portfolio allocation can be done fully on-chain. While we can expect stocks and bonds to come soon on the blockchain (using Backed Finance for instance), so far the investment world is limited to natives crypto-assets, gold and stablecoins. Not exactly the basis of a sound allocation.

There is also a need to understand, in a theoretical way, what drives the performance of a liquidity pool. For pure monotonic assets (assets going only up or down), in the absence of organic trades, such a strategy would result in a loss. Volatility and some mean reverting around a trend is much needed. Having a way to infer to profitability (if any) of an LP from the volatility and correlation of the underlying assets would be a great contribution.

Nevertheless, the fact that most assets would be provided as deep liquidity would result as a stabilization mechanism for the financial system. In Three Principles for Market-based Credit Regulation, Perry Merhling insist on the need of the Central Bank to be a dealer of last resort when commercial dealers are stopping doing their job. In this article, we show that passive investors could play this role and have an incentive to do so. This is made possible by the composability of Decentralized Finance.