Liquidity & Dexes

In this issue, let’s discuss about liquidity on decentralized exchanges, the role of cryptobanks and the difficulty to create liquidity for tokenized securities (or new markets in general).

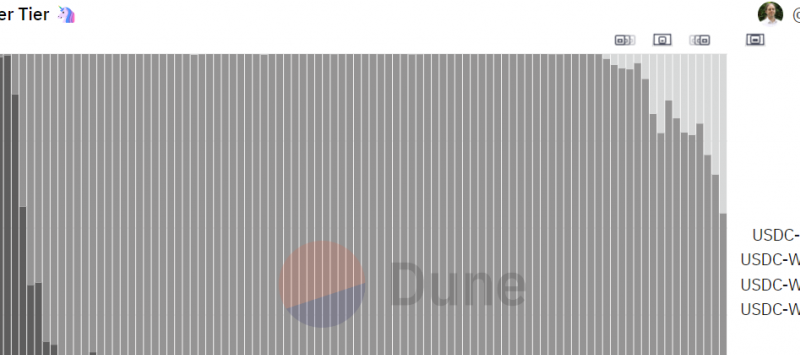

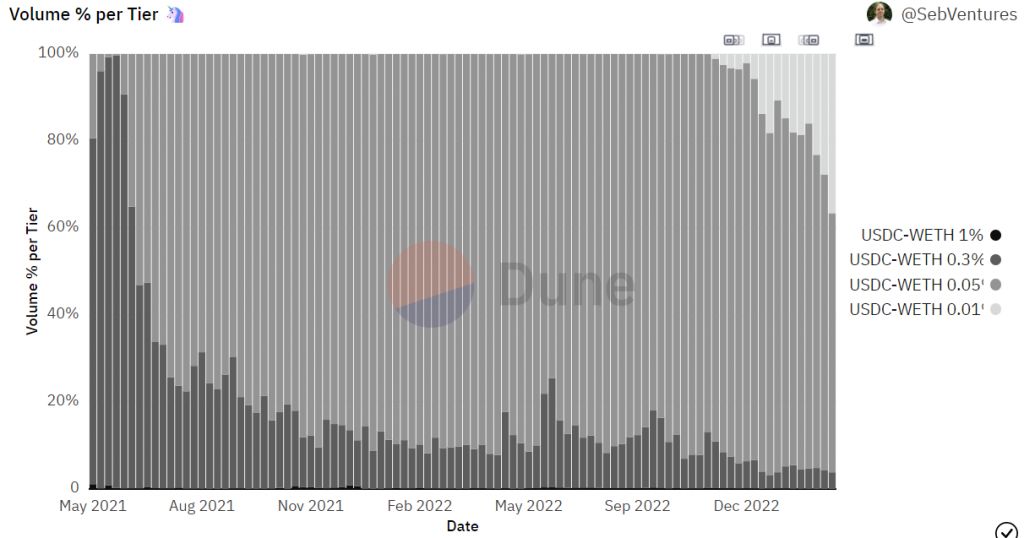

Lower fees on the ETH-USDC pair

Entering the third month of 2023, we see a pickup in the usage of a 1bps pool for the ETH-USDC pair. This is relevant as the trade ETH <> USD is by far the main one on Ethereum (some might say the only one).

Before Uniswap V3, the base rate was 30bps, which was uncompetitive with Centralized Exchanges. Therefore, in 2 years, we moved from 30bps to 5bps and then to 1bps. This is now quite good, I don’t know a lot of broker providing better pricing (and the same pricing for everyone, whales or shrimps).

How crypto banks have a role to play

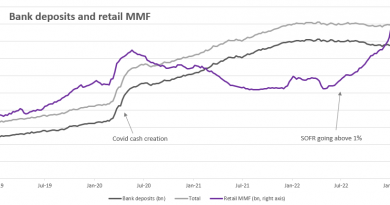

Circle and Uniswap have published a nice research on the role of stablecoins to solve foreign exchanges. First thing to say is that EUR-USD trading remains limited. DeFi is for now a USD-system. So discussing remittance for currencies not even tokenized yet seems quite early.

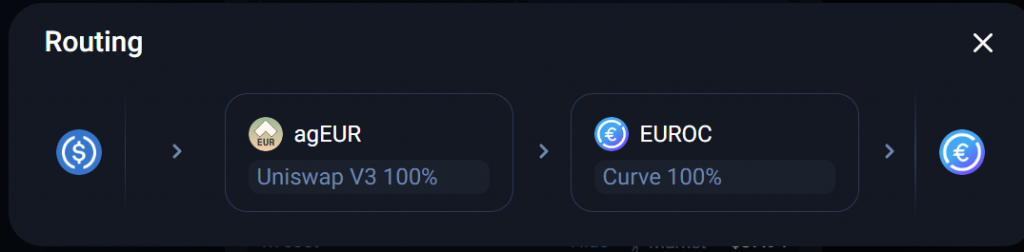

But one key point for this newsletter is that, when you swap USDC to EUROC, you are likely to use agEUR in the middle and both Uniswap and Curve (which, for obvious reasons, isn’t in the paper).

Angle is a DeFi stablecoin issuer. Those stablecoin are not fiat-backed but managed by a smart contract defining a more complex balance sheet.

One key component is that a DeFi stablecoin issuer can mint as much stablecoins as it wants and invest those anywhere (like a LP). This is an expansion of the balance sheet providing more liquidity to a market.

Assuming Angle issue both agEUR and agUSD, it could quite easily create a big agEUR-agUSD pool out of thin air and provide deep liquidity. Obviously, as Fei/Tribe discovered, you quickly get some FX risk that need quite some capital to absorb. You no longer have funding costs, but capital cost. The space is super early but I assume in the future, those cryptobank will be able to keep hedged books by using a future FX swap market (maybe related to the perps markets?).

Liquidity report on tokenized securities

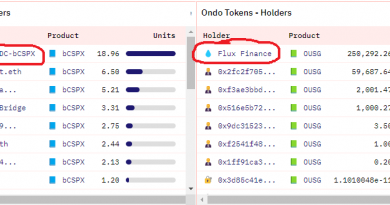

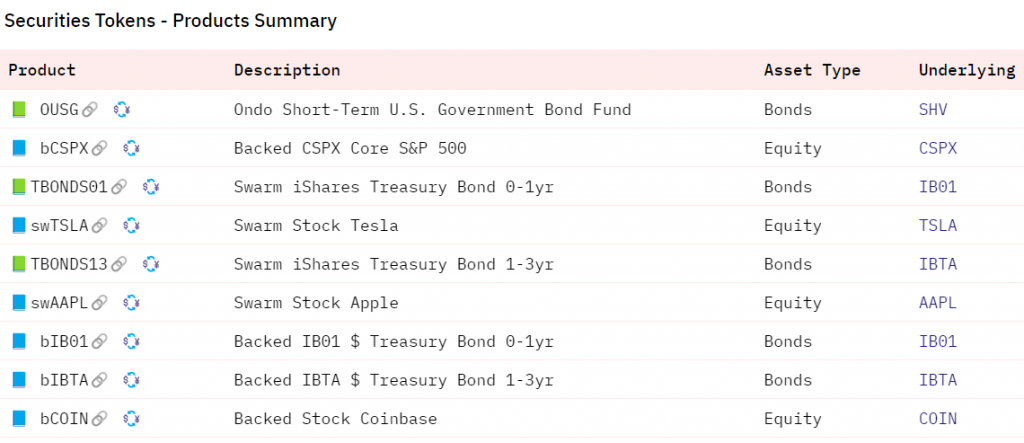

The list of tokenized securities (at least a subset) is growing. Swarm Markets products were added as well a new Backed products. We now have 3 products in very short-term treasury bonds (OUSG, TBONDS01 and bIB01). Overall most of the TVL is in OUSG.

As I’m writing, bCSPX (S&P 500) price is $423 versus $422 off-chain (and $428 on Arbitrum). But this good result is only as of today as price was quite off last week. Swarm offerings are quite limited as well.

It is challenging to get liquidity on the secondary markets. Without good liquidity (and trust that liquidity will stay), no one uses them which, in return, makes liquidity provisioning not attractive (in a way similar in a different scale to EUROC of the beginning of the issue).

We will see how it plays out!