2023, the year of tokenized public securities

On Ondo and Backed launch and strategies

In the Crypto Banking System, I put quite an tokenized public credit. After working on the so called Real-World Assets (RWA), I realized that a low hanging fruit was to rely on the most trusted and liquid products in TradFi, ETFs.

We have not one but two great projects in this area that have launched: Ondo Finance and Backed Finance.

Thanks for reading CryptoBanking – Where DeFi and TradFi meet! Subscribe for free to receive new posts and support my work.

Subscribed

While Backed has launched an equity-linked product bCSPX, a 1 to 1 wrapper for CSPX, a S&P500 ETF, Ondo has launched a short-term bond product, OUSG, a fund mostly invested in SHV (3-4 months duration treasuries). Notice that both underlying products are ETFs from Blackrock/iShares.

While Ondo business model is AuM fees (15bps annual for bCSPX), Backed is taking issuance/redemption fees on the primary market.

While Backed is permissionless (on the secondary market) and forbidden to US citizens, Ondo is permissioned and accessible only to KYCed accredited investors. This leads to two very separated deployment strategies.

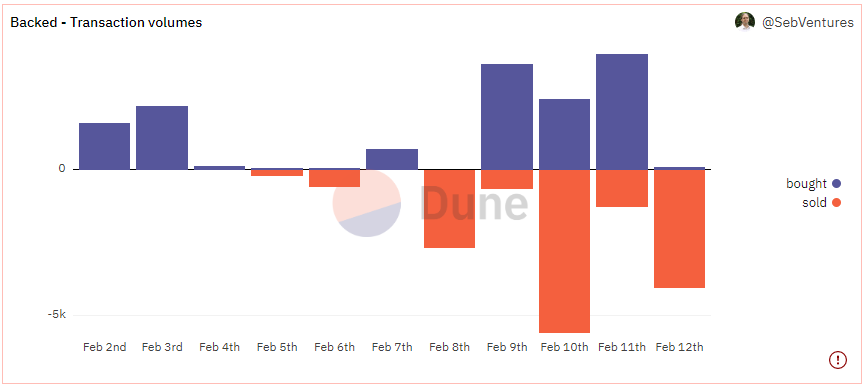

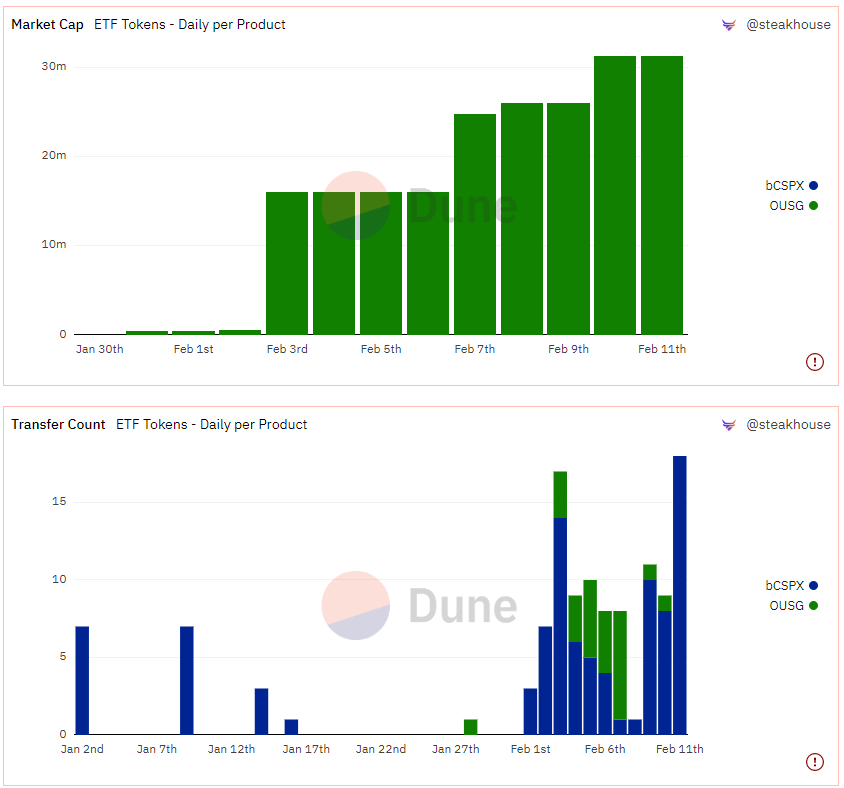

Backed needs a strong secondary market and therefore needs a strong DEX presence. Start is quite slow as in the first days liquidity was really thin (some would say that I make soft launches difficult 🙂 ).

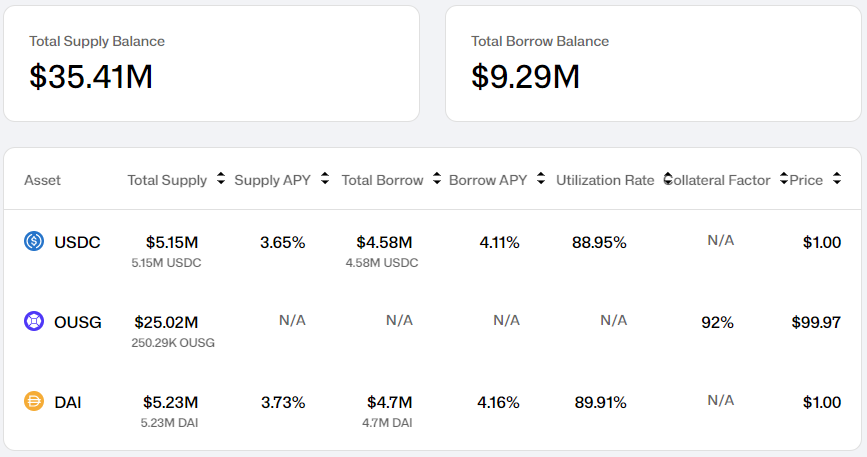

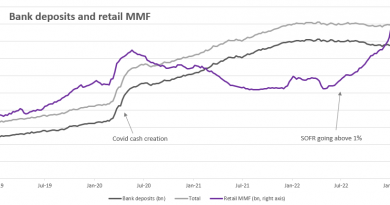

On the other hand, Ondo has come up with an innovative way to extend its reach: Flux Finance, a Compound fork that allows permissionless funding supply to refinance the permissioned token OUSG. A more detailed discussion can be found here, but suffice to say that lender should get SOFR – 50bps. one could say that 50bps is the cost of block liquidity and being an anon.

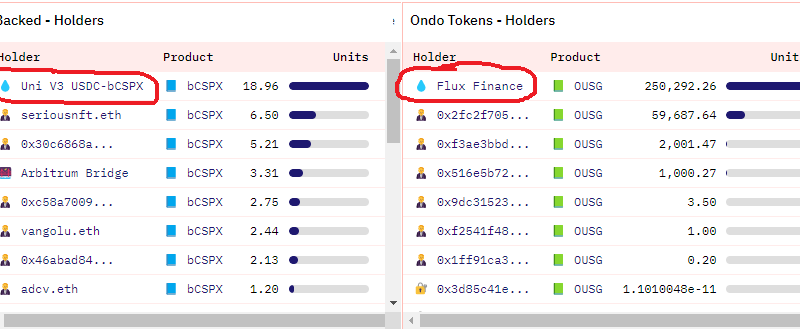

Those two strategies can be seen on where the tokens are, which is Uniswap for bCSPX and Flux Finance for OSDG. It makes complete sense.

Both protocols are early. Backed outstanding volume is a small $23k, Ondo is significantly larger at $25M but most of it seem to be hold by the team or related party, same for the funding on Ondo (~95%).

Both products seem strong and provide much needed DeFi primitives (TradFi money market and equity indices).

I’m excited to follow their developments. I will report in this newsletter and meanwhile you can track my Dune dashboards: