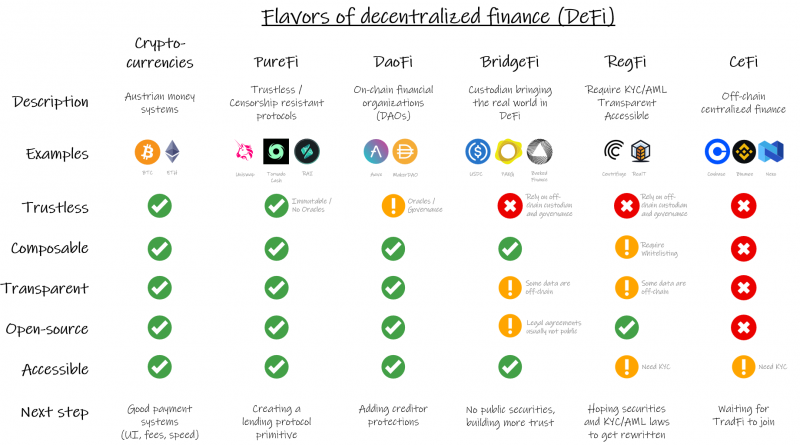

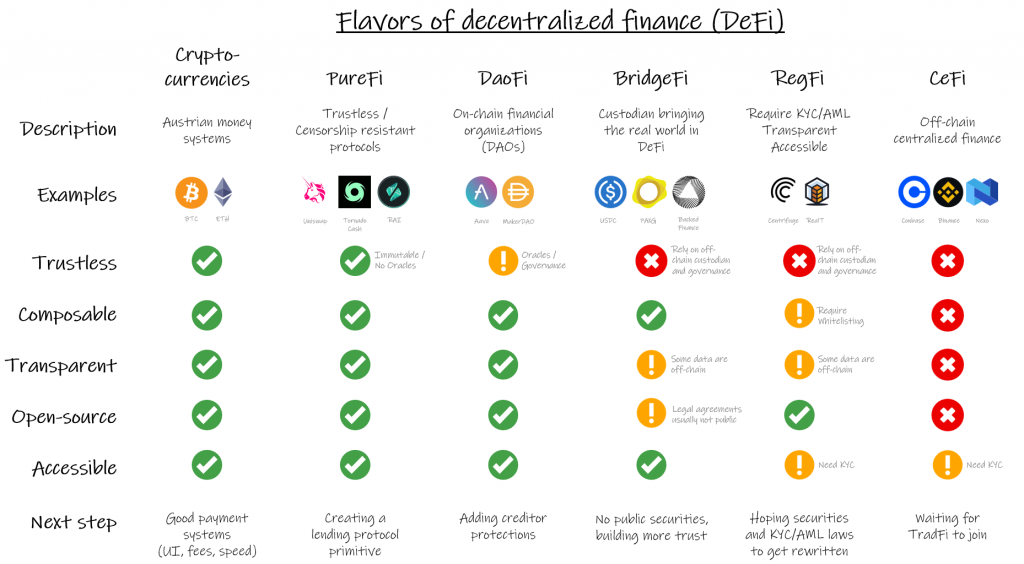

Almost 50 flavors of crypto finance

While the broader narrative is about the death of crypto following the Terra/Luna and FTX scandals, it makes sense to dig inside what we can call crypto or specifically decentralized finance (DeFi). As commissioner Peirce mentioned, crypto is not a monolith.

each crypto asset, blockchain, and project needs to be assessed on its own merits. Talking about crypto as if it is a monolith obscures important differences and makes it easier for scammers to hide in the crowd.

We suggest here a nomenclature of crypto-finance project. Any endeavor to create a nomenclature is nevertheless doomed to fail, as it is a multidimensional continuum more that a few categories. This categorization is therefore more defined to elaborate on qualities of those crypto-finance projects and less about providing a definitive framework.

Crypto-currencies

The first flavor of crypto-finance is crypto-currencies. This is the ultra-sound money meme in action or the Austrian economic dream of Bitcoiners. It is explored in the Synthetic community money paper by George Selgin.

One can use BTC or ETH in this category. Both are very trustless, immutable, composable, transparent, open-source and accessible. They aim to be a generally accepted form of money, which they are not yet, but have strong arguments.

The current problem is their lack of good payment system (which seems basic for a form of money). It seems it was easier to make (digital) purchases in 2015/2016 than in 2023.

Beyond this flavor, the rest of this article is more about providing finance on top of money and is indifferent to the form of money is is based on (which can be a fiat currency of a crypto-currency). Crypto-finance is orthogonal to crypto-currencies.

PureFi

The PureFi flavor is what people usually expect (but don’t get) when they speak about Decentralized Finance (DeFi). Those protocols are governed by their smart contracts and there is no external dependencies.

Any feature change (including bug fixes) requires a new smart contract deployment. Users will also need to migrate to the new version. The older version will remains forever on the blockchain for anyone to use.

Building a business in PureFi is challenging. As the protocol is only based on open-source code, any tentative to extract fees can be countered by anyone redeploying the contracts.

The most famous example here is Uniswap which allows to trade tokens. At least up to version 3, all contracts are immutable. The first version is still alive and used. They are censorship resistant as no one can do anything about it. For instance, Uniswap Labs removed the security tokens from its interface. Yet, they are still traded on Uniswap v2 (here for example). The price of the swap is derived internally and there can’t be any so called “Oracle attack”. There is a fee switch which would divert some transaction fees to UNI holders, but it wasn’t activated yet and it seems unlikely to be activated.

PureFi protocols are of paramount importance as those are bricks on which you can safely build. Yet the trustless constraint is difficult to integrate. For instance, currently there is no PureFi lending protocols (also this should change in the coming months).

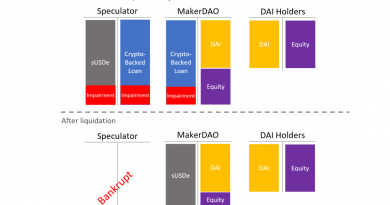

DaoFi

While PureFi represents the gold standard of DeFi, the limitation of smart contracts makes it sometimes necessary to add two external components: oracles and governance. Oracles deliver exogenous information to the blockchain like the price of a crypto-currency or a commodity. Governance allows people, usually governance tokenholders, to make changes to the protocol like changing fees, setting new interest rates, updating the protocol, … .

Both of those external dependencies are risky, Oracle manipulation are one of the biggest reasons for hacks and the example on Mango shows a case where an attacker used a oracle price manipulation to steal funds, then used those stolen fund to vote a governance action to whitewash his actions. Chainlink, biggest Oracle protocol is for instance managed with a 4 out of 9 multisig with unknown signers, which is not considered strong on a decentralization spectrum.

Moreover, governance is usually working like a group of shareholders incentivize to maximize their value. There is very limited, if any, minority tokenholders protection or creditor protection. It is the case that a majority of MKR tokenholders could collude to steal all the collateral, not only of MakerDAO but also from Compound v2 and Aave v2. The fact that such attack has almost no chance of happening shouldn’t be taken as an excuse to not create new standards of safety. Governance can also vanish as in the case of Fei Protocol that was shut down.

Those shortcomings shouldn’t discard DAOs. In my view the main difference between a DAO and a corporation is mainly a cultural one by working the the open. We should move from the cultural part (and to some extend regulatory arbitrage) and improve the smart contract part (and I couldn’t care less if it’s a DAO or a regular LLC).

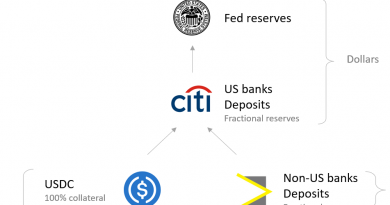

BridgeFi

BridgeFi encompass projects that allows to bring on-chain assets that aren’t endogenous to it. The biggest examples are the fiat-backed stablecoins, where a company issued 1 token (e.g. USDC) for each US Dollar it has under management.

The primary market (creation and redemption) is usually limited to KYC people only, but the secondary market is wide open, meaning anyone can transfer the tokens freely. There is a blacklist to freeze accounts (which is not great) but so far it has worked well. This at least enable composability within the space.

Those projects are based on trust. In that light, it should be mandatory for them to provide audited financial statements and use narrow purpose entities (bankruptcy remote SPVs from the rest of the company).

So far, we are not there yet. Lindy effect is more prevalent that transparency as a metric. Despite the lack of clarity of Tether, USDT remains one of the most used stablecoin in the crypto-economy. Details on the legal structure are usually not disclosed and we have a best the virtual safety of regulation under money transmitter or limited chartered trust.

A good example is WBTC, which bridge Bitcoin to Ethereum. While you have both an on-chain link on the asset and liabilities, there is no trace whatsoever of any legal agreement between BitGo and a WBTC DAO. MakerDAO for instance is mentioned as a member but never was (probably Maker Foundation was, but it is now defunct and no one seem to remember where the key is). This obviously lead to trust being shaken every now and then.

This is quite an uncomforting situation as we can’t build a trillion dollars ecosystem on top of black boxes. Without the much needed transparency and openness, the future is not bright if we can’t solve that.

RegFi

One type of BridgeFi project are similar but qualitatively different due to the use of a whitelist, a list of accounts allowed to hold the token. This limit composability a lot making any product an order of magnitude, at least, less used. Some solutions to create bridges are explored but they obviously are less than ideal.

This state of affair is solely due to the SEC and securities laws in the US which is quite unfortunate as the discussion moves to regulation compliance instead of the actual safety of a token (full disclosure, I lost all hope on the securities laws and protecting the retail investor with the launch of APE).

Quite unexpectedly, this space is showing quite significant progress towards a better safety and transparency. For one, all users need to sign some kind of agreement so they actually have some legal documents with is already a progress. But, moreover, . You can for instance find all the legal documentation of the MakerDAO HVB deal on the permaweb. This should be the case every time, just like the code of smart contract is published, so should be the legal documents.

CeFi

Finally, we arrive at CeFi, for Centralized Finance. Those are the FTX, BlockFi and Genesis of the world. They attract a lot of attention and negative press around crypto but are quite orthogonal to DeFi. They live in the shadows and provide no transparency whatsoever. Neither are they composable. If they blow up, they can’t damage DeFi as they have no link to it.

Terra/Luca would also be listed there. If you just reduce Terra/Luna to the on-chain activities, then it would be a DaoFi, and it was for all to see the shortcomings (as noted in this tweet, Terra was clearly insolvent by design). But part of the Terra narrative was also reserves (which weren’t enough anyway) hold at the Luna Foundation Guard. And they obviously disappeared without a clear trail (there was an audit it seems but it is no longer online so who knows).

One should still mention that Coinbase is publicly listed which makes it somewhat transparent. They also issued cbETH which would be in the BridgeFi category.

Conclusion

As we have seen, the crypto universe is filled with projects that are on different point in the “decentralization” spectrum (if that means something at all). It is unclear what will be the state of the industry in 5 years but here are some key learnings I made along the way:

- Crypto-currencies may or may not be more money-like in the future. That doesn’t have any meaningful impact on the rest of the ecosystem.

- The jury is still open on the extend in which PureFi can grow. It is the gold standard of DeFi and we should devote more resources on this area. It doesn’t mean that PureFi should be against tokenized off-chain assets, they are a lower level building bloc, real public goods.

- BridgeFi, bringing off-chain assets in DeFi should be significantly improved in term of transparency (audited financial audit) and all legal docs tied in the off-chain world should be open-source.

- DAOs should also improve minority tokenholders and creditor protections. The key shouldn’t to recreate organizational framework but to migrate what already exist in a smart-contract way.

We are early, but the next steps will be significant to define where we will land. I’m sympathetic to those claiming that anything beyond PureFi is evil. Personally, I want to minimize the amount of RegFi and CeFi. Finance should be let to walled garden only for the big financial institutions like it is today. We need to level the playing field and allow everyone to participate. A good mix of PureFi (maximized), BridgeFi (with transparence) and DaoFi (for complex protocols) is needed to create a sound Crypto-Banking System.

And I have no doubt that ETH will become international money in that case.