Accounting primer for crypto-banks

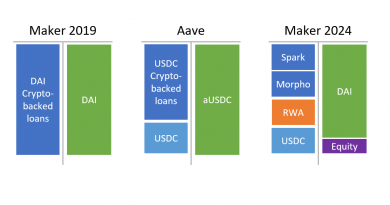

In this paper, we will go through the basic accounting building blocks of a crypto-bank. A crypto bank is a DeFi protocol that engage in the issuance of a stablecoin and maturity transformation as it use the proceeds for longer dated investments. This maturity transformation makes it a key element in the crypto-banking system. It is not a bank as there is no contractual basis for the stablecoin to be redeemed on-demand. Nevertheless, as we established in crypto-bank 101, in order to be useful stablecoin issuers (crypto-banks) should remain both liquid and solvent.

Crypto-Accounting 101

Accounting is the process of recording financial transactions. We use double-entry bookkeeping because each transaction has two legs, where the financial value is coming from (credit) and where it is going (debit). A financial transaction can have many credited accounts and many debited accounts but for each transaction, sum of credits equals sum of debits.

A balance sheet represents an entity by listing what it owns (assets, e.g. stablecoins, crypto-currencies) and what it owes (liabilities, e.g. loans). The difference of asset minus liabilities represents the equity, i.e. the net worth of the entity. By construction we have the rule asset = liabilities + equity.

One particularity of crypto-accounting is that we don’t have a separate set of accounts for the income statement that are aggregated and moved to the balance sheet (retained earnings) during the closing process. As the blockchain never sleeps, we input all the revenues and expenses on accounts under the retained earnings in the equity section of the balance sheet. The whole accounting process is reduced to a balance sheet without losing any information.

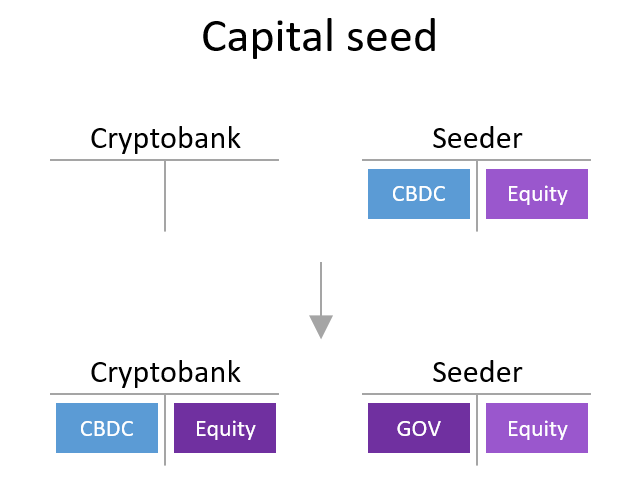

Capital seed

While not necessary, to make the crypto-bank more robust seeding it with initial capital could help it manage asset fluctuation and remain solvent. We will assume the existence of a CBDC (Central bank Digital Currency), but any unit of account anchor could work, like USDC. Therefore, a capital seed will increase the asset side with the CBDC and, by construction, increase the equity portion as well. The seeder entity can get compensated with a governance token (GOV) that could bring some rights or nothing. We show here the creation of a GOV token (just like Fei protocol did by issuing the TRIBE governance token when people seeded its capital with ETH). While the equity of crypto-bank is derived by the amount of CBDC on the asset side, the financial value of GOV can fluctuate and depend on the secondary market price of the token.

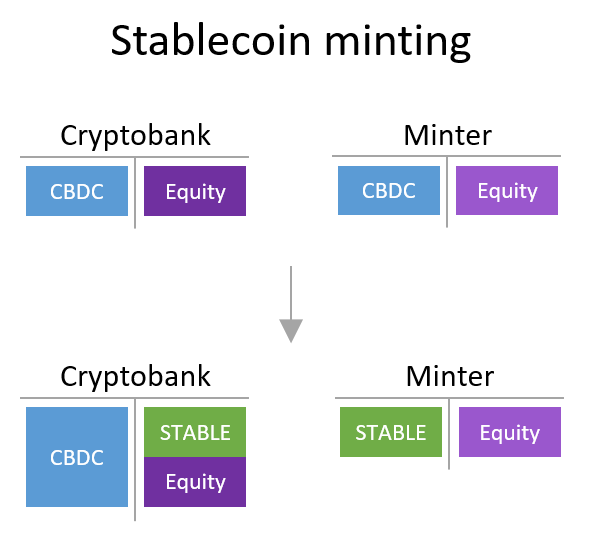

Stablecoin minting

The easiest way to mint a stablecoin is by providing the unit of account reserve asset. A minter (user), can mint one unit of stablecoin by depositing one unit of CBDC to the crypto-bank protocol. For the minter, it’s just a swap from CBDC to STABLE. For the cryptobank, it extends the balance sheet by adding CBDC on the asset and creating STABLE liabilities.

Nothing prevents the minting to be allowed with any arbitrary asset, but that could lead to some pricing complexities. As well, the cryptobank could charge fees on the operation that would increase the equity.

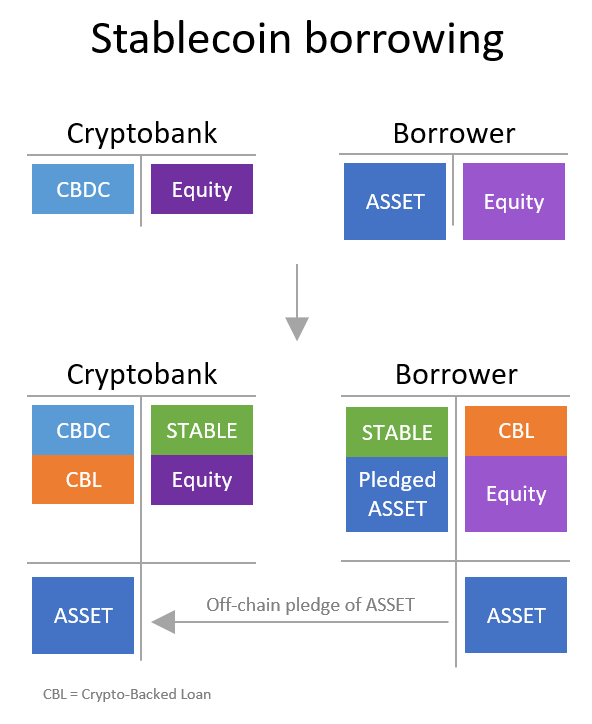

Stablecoin borrowing

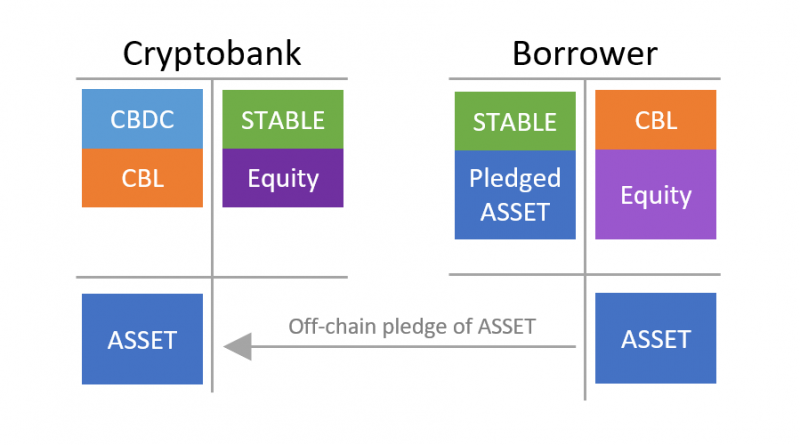

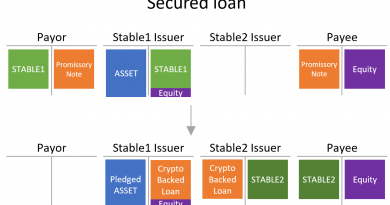

Another way to get the stablecoin is to take a loan from the cryptobank. All loan are secured by somme collateral represented by ASSET, hence the name crypto-backed loans (CBL). The ASSET can be a crypto-currency or a tokenized traditional asset, the constraint being the need of a healthy secondary market to source a price and dispose of the collateral if need be to repay the debt.

The ASSET remains the property of the borrower but is pledged (usually locking it with a vault/escrow smart contract). No rehypothecation is allowed in this example. The borrower gets a stablecoin (claim on the cryptobank), while the cryptobank gets a secured claim on the borrower. This is what Perry Mehrling call a swap of IOU. The pledge is represented on the bottom as an off-balance sheet item.

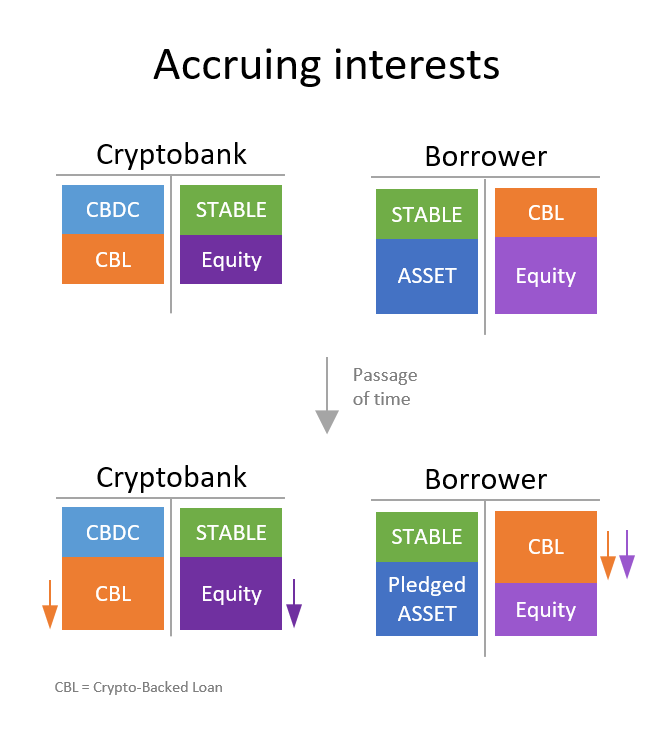

Accruing interests

After a loan is extended to a borrower, interest start to accrue. The crypto-backed loan value increases, both as an asset of the cryptobank and as a liability of the borrower. By construction, this increases the equity of the cryptobank while decreasing the equity of the borrower.

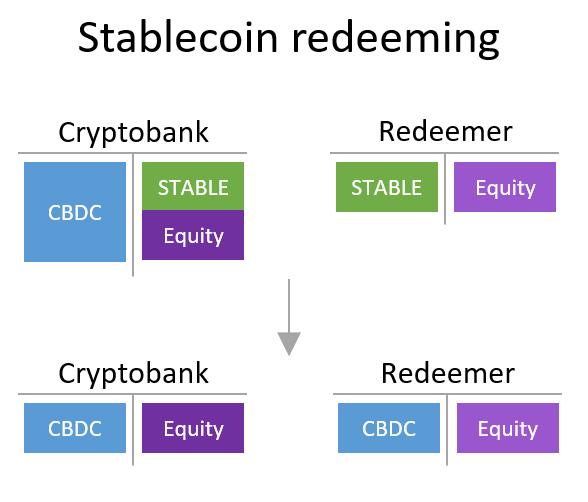

Stablecoin redeeming

If someone borrows a stablecoin from a cryptobank, chances are it is not to keep it idle but to make a payment. In order to keep par (the peg), it is also important that stablecoin holders can redeem them for the CBDC or another stablecoin at any time. As you can see on the diagram below, redeeming a STABLE is just a swap from the STABLE to the CBDC for the redeemer but a balance sheet reduction for the cryptobank.

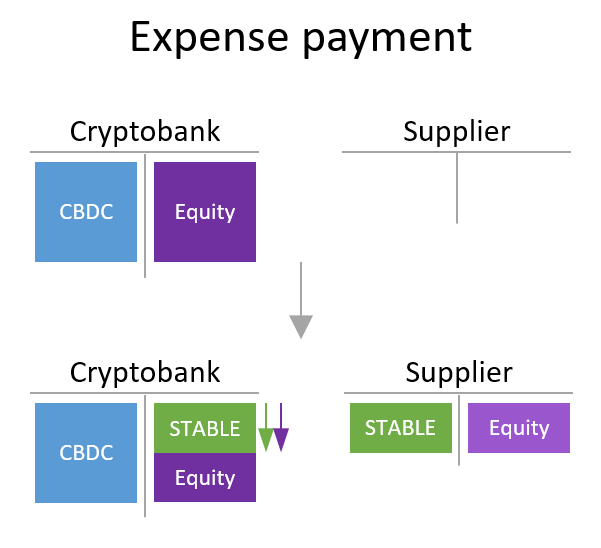

Expense payment

An interesting part of a cryptobank is that it is able to issue stablecoins, therefore, assuming a supplier is accepting the stablecoin, the payment of an expense is not decreasing the asset side of the balance sheet (like it would for any other business) but increasing the liabilities (and, for both cases, decreasing the amount of equity).

Should the supplier prefer another kind of stablecoin, maybe the CBDC, then the process is just followed by the stablecoin redeem process.