Banks and Stablecoins Turbulence

and the Rising Appeal of Money Market Fund

Last weekend’s SVB failure was undeniably a significant event that kept us all awake and working. What can we learn from it, and how can we apply this knowledge to DeFi?

The migration towards safe and yielding assets

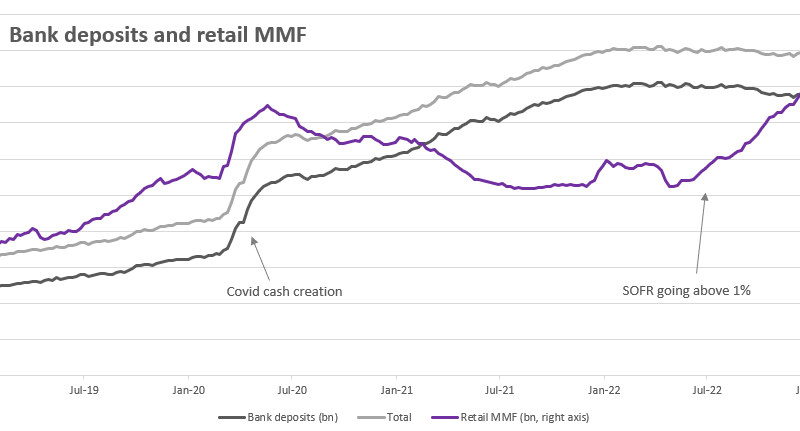

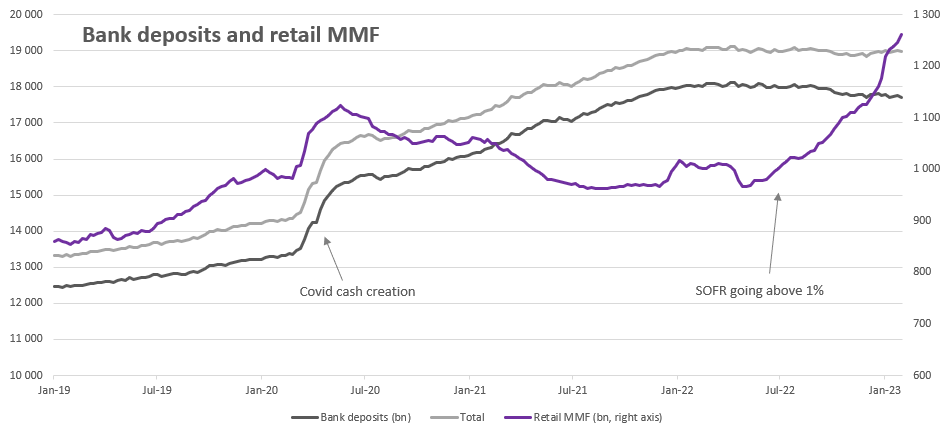

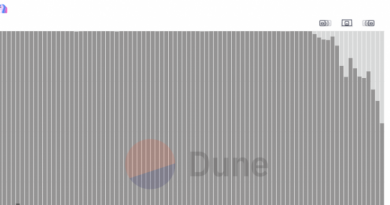

The graph below demonstrates that bank deposits have been declining since last year. This decline is correlated (r=0.9) with inflows into money market funds (MMF). Indeed, why would you keep money in an uninsured (i.e., risky) bank deposit that barely pays you anything when you can earn more by investing in the safest asset in the dollar world?

It should be noted that while bank deposits have only decreased by 3.2% (before the storm), such a decline has only occurred when Lehman failed, and only the 9/11 events caused a more significant drawdown (5%). Both instances took place during periods of decreasing interest rates, which increased the value of high-duration assets.

Gresham’s law in action

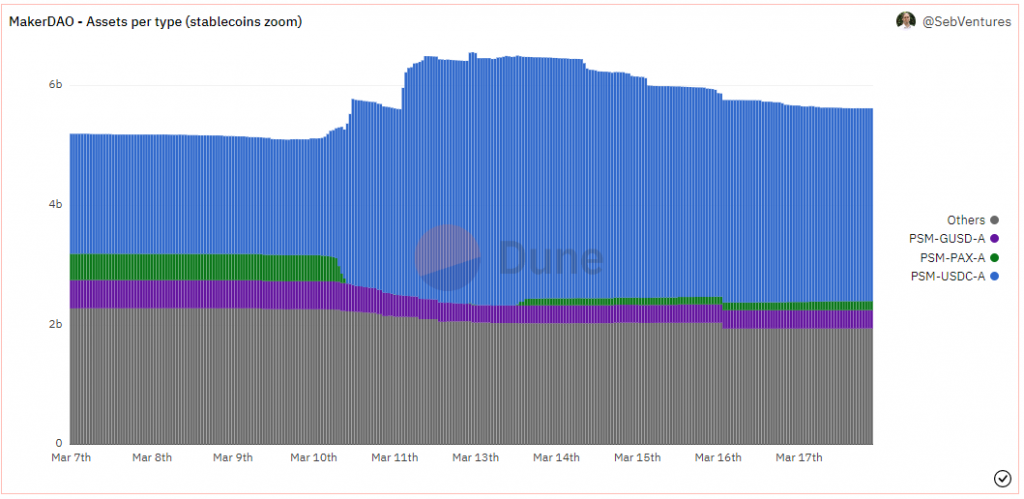

Examining DeFi and MakerDAO’s evolution over the weekend in detail, we can see Gresham’s law in action: “bad money drives out good.” Within a few hours, market participants dumped the “bad money,” USDC, to take the good, “USDP” (or PAX, the old name in the chart below). $420M of USDC vanished. GUSD was treated more cautiously as liquidity is lower, and market participants didn’t know at the time that GUSD was the safest coin during the weekend (only deposits in systemic banks).

The inflow of USDC was only contained by the smart contract, which allowed a $950M USDC increase per day. The issue was that USDC was hardcoded at $1. This will be addressed.

What next?

The trend towards MMF will likely only grow stronger. There is friction in TradFi when it comes to entering and exiting MMF. I attempted to use MMF with my digital-native bank, and it was quite challenging – something that should be as simple as a one-click “sweep.” When I found the MMF, they were charging a 1% annual fee. Unbelievable! There is clearly a market for a FinTech company to create a user-friendly interface.

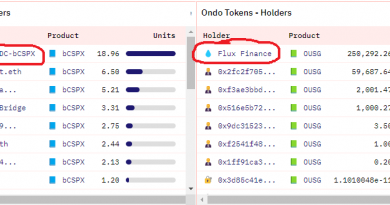

In DeFi, MMFs are just getting started. Ondo, Swarm Market, and Backed Finance all launched short-term treasury products earlier this year. So far, only OUSG has gained traction. bIB01 from Backed is permissionless and appeared on Uniswap earlier this week, but liquidity is limited. I remain bullish on this space, as it clearly addresses a problem. I maintain a dashboard and am happy to help you understand the market (just DM me). Unlike TradFi, you can use bIB01 and swap it for any other ERC20 token at any time.

On a larger scale, the shift from longer-term treasuries funded by bank deposits to T-bill MMFs will require the Fed to expand its balance sheet and provide maturity transformation. This change could also lead to the return of the term premium (which I believe has largely disappeared due to QE) on longer maturities and credit spreads on corporates.

Moreover, the market is anticipating money debasement. Gold, BTC, and ETH are on the rise.