How money market interest rates affect stablecoins

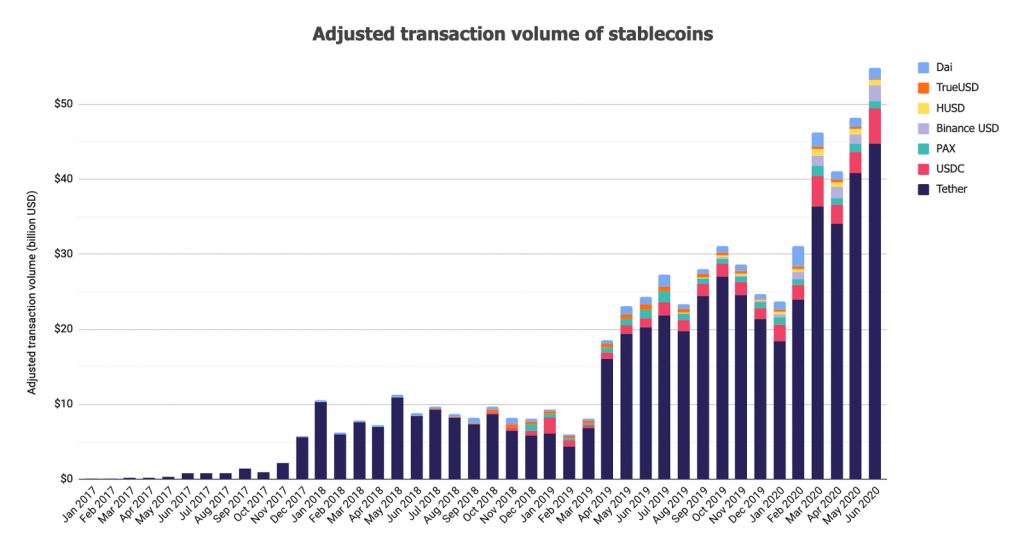

I advocated 2 years ago that stablecoins will see massive adoption. That true by market capitalization and by transactions volume. Interestingly, the big winner is still the unreliable Tether/USDT.

There is 4 main players in the field :

- Tether (USDT) : somewhat backed by USD reserve

- Circle (USDC) : reserve backed

- Paxos (PAX, BUSD, HUSD) : Paxos is holding reserve in a trust in NY.

- MakerDao (DAI) : collateral backed

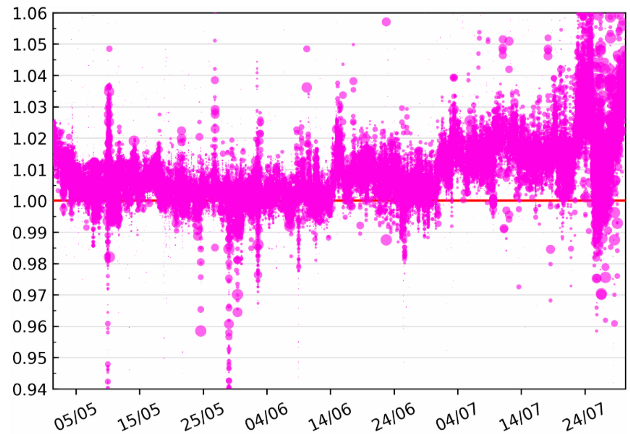

The first three have an exchange rate that follow closely $1 per coin. DAI fails to keep the peg and is priced $1.03 as of writing.

In the following, I will discuss how interest rates can have an influence on stablecoin preference and exchange rate.

Interest rates, market capitalization and exchange rates — a theory

In the economic theory, all else being equal, raising interest rate in a country make its currency more expensive. That is because you can set and arbitrage where you borrow money in the low interest rate currency and convert it to the higher yielding currency. You earn the spread difference minus exchange rate change. In a perfect market, the cost to cover against the currency variation is equal to the spread you can earn.

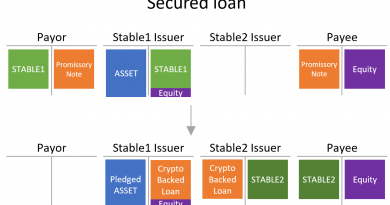

Now, for stablecoin that are all pegged to the dollars, what are the implication? If a stablecoin has a borrowing rate less than the supply rate of another, there is an arbitrage to be made. Such arbitrage will impact the supply and demand for those stablecoins and should impact exchange rates.

Nevertheless, 3 of those stablecoins are fiat-backed. The exchange rate of a USDC and USD is designed to be 1. If it deviate, there is a risk free arbitrage to be made. If 1 USDC = 1.1 PAX, you can buy 1 USDC with $1 (fiat) convert it to 1.1 PAX and redeem $1.1 from Paxos.

Therefore, for those 3 stablecoins, interest rates should be the same after arbitrage. If one stablecoin can provide higher supply interest rate and can’t be arbitraged (there might be some cases), it will increase its market cap.

DAI is different. You can’t withdraw $1 from 1 DAI. Vault owners can redeem their collateral (mainly ETH) but there is no arbitrage with a strong incentive. Each time you must make an assumption about the future value of DAI.

Risk-free interest rate in the DeFi economy

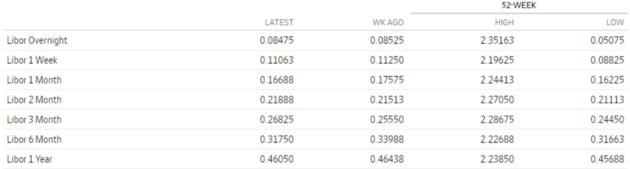

In the real world, the interest rate used in the previous discussion is influenced by the central bank and clearly followed in the money market.

Let’s use the interbank interest rate which is the LIBOR for USD. We have not only a overnight rate, but we can have a rate for any duration up to one year (the yield curve can be different from one currency to the other).

As DeFi is not as developed as traditional finance, there is no accepted money markets and currently no yield curve (but the later might happen soon).

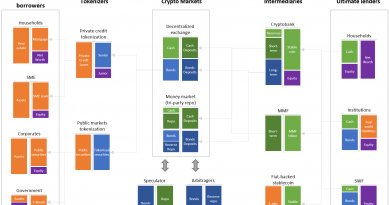

The closest thing to money markets are MakerDAO, Aave and Compound which allow to deposit coins as collateral and borrow some coins.

Stablecoins money markets

In DeFi money markets, the collateral value should stay above significantly the borrowed value or the position is liquidated (more like a repo).

There is supply (lending) rate and a borrowing rate. There is two reason for that. First, the protocol take a cut. Second, you can supply liquidity but it is not borrowed. The borrowed share pay an interest on the overall liquidity. each money market can have its own formula to allocate lending earnings which can even be different for each stablecoin.

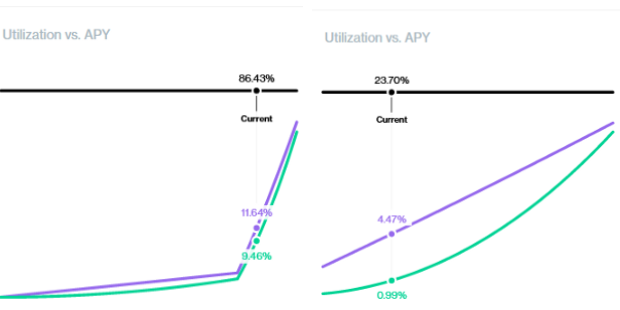

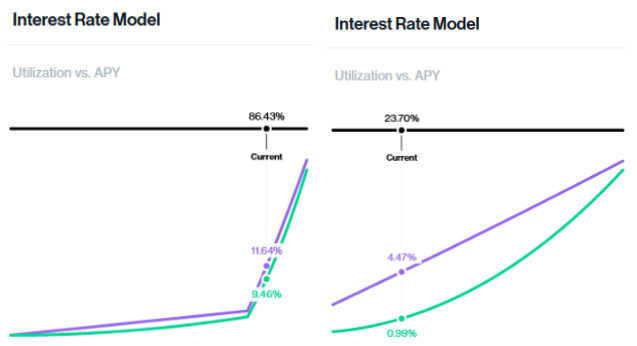

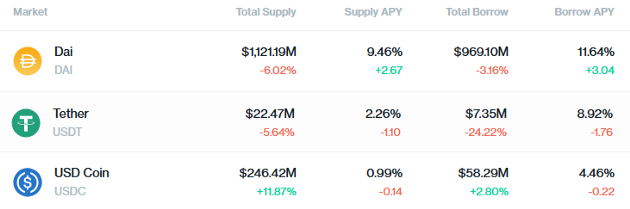

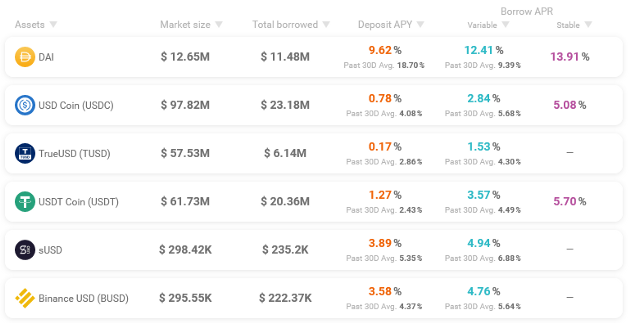

Below are the two main money market Aave and Compound with a focus on the stablecoins supply and borrowing rates.

As you can see, DAI has supply and borrowing rates far higher than the others. One reason is the COMP farming where people get COMP token as a reward to use Compound. This lead to a strong utilization of DAI and therefore high interest rates.

There is a strong arbitrage to be made here, borrowing USDC @ 4.46% convert them to DAI to supply them @ 9.62%. Even better, you can do the same using Maker and creating a USDC-A vault to borrow DAI from USDC at 4%. Maker rates are usually more stable securing the supply and avoid exchange rate risk between USDC and DAI.

The economic theory tell us that the high supply rate is the reason (or one of the reasons) that DAI price increased in the first place. With a DAI @ 1.03 it’s too risky to buy DAI to supply the DAI pool (you need 4 months of 9% interest to compensate for the exchange loss if DAI goes back to 1).

The spread is therefore 5.62% currently (and you can leveraged that up for more yield).

I think this arbitrage is not used for 3 reasons :

- Not widely known, Maker doesn’t get much exposure with the yield farming narrative as it does not participate

- The yield is still small comparing to COMP farming leading to an opportunity cost

- Due to the DAI interest rate model on Compound it will soon be a losing proposition. At 80% DAI pool usage, the supply rate drop @ 4.03% losing all interest in the trade.

MakerDAO can’t provide a risk free arbitrage that incentivize market participants to expand the supply of DAI (unlike other stablecoins). Therefore some participant are willing to pay DAI higher for get those high interest rates(the capture from Aave show a 18% yield on DAI over the last 30d).

Last minute game changer

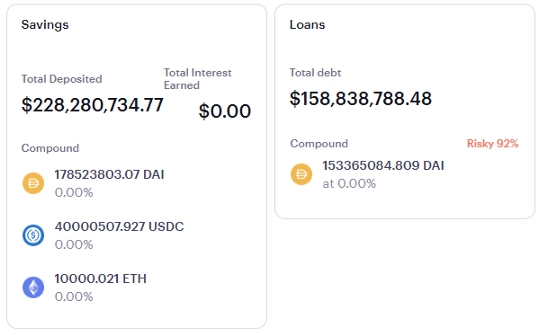

In less than 4 hours, the Base Rate Adjustment weekly pool of MakerDAO will end. Currently the wining base rate is -4%. Borrowing DAI against USDC on MakerDAO will therefore cost 0%. This will increase the arbitrage yield AND securing the strategy while removing all exchange rate risks.

We will soon see if the theory is correct in the real DeFi world.