The Dealer Function in the Cryptobanking Era

While the DeFi market is experiencing rapid growth, trading within it remains relatively simplistic and capital inefficient. It relies heavily on liquidity pools (typically between two tokens) where capital remains largely unproductive. Although there have been attempts to leverage DeFi composability to put this idle capital to work (in money markets), high gas fees hindered adoption. Even with the advent of Layer 2 solutions, this approach hasn’t gained significant traction and remains limited in scope.

For instance, the 3pool, a crucial swap facility for stablecoins (DAI, USDC, and USDT), holds a substantial $176 million in assets. However, the return on capital is a mere low single-digit percentage (1-3% depending on flows). Even with the addition of CRV governance token rewards (below 1%), it remains less profitable than investing in the risk-free rate (through tokenized t-bills or yield-bearing stablecoins).

In contrast, traditional finance (TradFi), which lacks the liquidity pool structure, relies on dealers – firms that leverage their balance sheets to provide pricing and facilitate trades. Importantly, dealers can refinance themselves and delay trade settlement by expanding their balance sheets (i.e., borrowing). This allows immediate settlement for the buyer/seller, while the dealer carries the inventory until a counterparty is found. This approach is characteristic of speculative dealers (not matched books).

This article proposes an abstracted Dealer model capable of providing immediate pricing and inventory by expanding its balance sheet, thereby carrying over any imbalance. This model aims to increase available trading liquidity and reduce misallocated capital for liquidity provision. It relies on money markets for just-in-time liquidity provision. We explore the model’s potential benefits through two use cases: atomic liquidity for tokenized securities and capital-efficient FX trading.

Atomic liquidity for tokenized securities

Tokenized securities on the blockchain have experienced steady growth since early 2021, reaching over a billion dollars on the Ethereum blockchain according to Steakhouse Dashboard. Most of these are tokenized t-bills or similar instruments. They offer a superior store of value compared to non-yielding stablecoins. However, they suffer from a significant drawback: lack of liquidity. Unlike lending protocols (used to earn a yield on a non yielding stablecoin) where users can seamlessly enter and exit positions (assuming adequate liquidity), tokenized securities often require interacting directly with the primary issuer, either through a UI (which breaks composability) or by waiting for settlement. While some issuers have integrated atomic liquidity into their products (e.g., OpenEden), this is not the norm. Additionally, even with built-in liquidity, the capital inefficiency of holding stablecoins remains unaddressed.

Some issuers offer secondary liquidity facilities, the largest being the USDC liquidity provision for BlackRock’s BUIDL product and Teller for Hashnote USYC. However, the daily trading volume is limited to a low single-digit percentage of the immobilized liquidity.

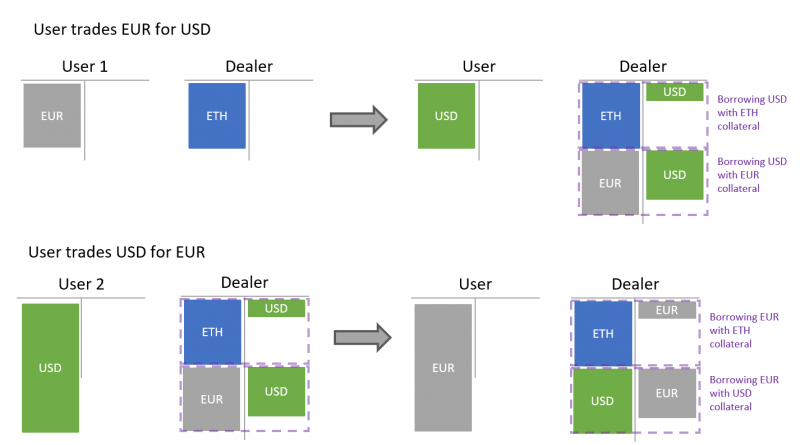

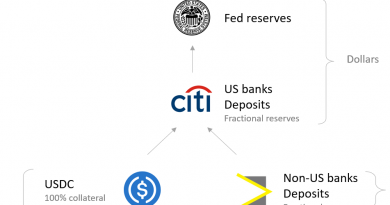

We propose an alternative approach, as illustrated in the diagram below. User 1 wishes to sell a tokenized T-Bill token (TBILL) for a stablecoin (USD). The Dealer, a smart contract initially seeded only with some ETH, provides liquidity. When User 1 sells the TBILL to the Dealer, the latter uses it as additional collateral on a lending protocol to borrow the USD needed to pay User 1. This occurs atomically, and from User 1’s perspective, the transaction is complete.

On the Dealer’s side, the situation is different. The Dealer’s balance sheet is now extended, and assuming the USD funding costs exceed the TBILL yield, the Dealer is in a loss-making position (though the Dealer can, of course, make a spread on the trade).

However, we can assume another user, User 2, will eventually want to buy the TBILL with USD. This could be through organic trading activity, the Dealer settling with the primary issuer, or a profit-driven user (if the Dealer provides an incentive). When User 2 buys the TBILL with USD, the Dealer can repay the USD loan, which unlocks (partially or fully) the TBILL used as collateral to be given to the buyer. Ignoring fees, incentives, and interest rates, the Dealer’s balance sheet returns to its initial state.

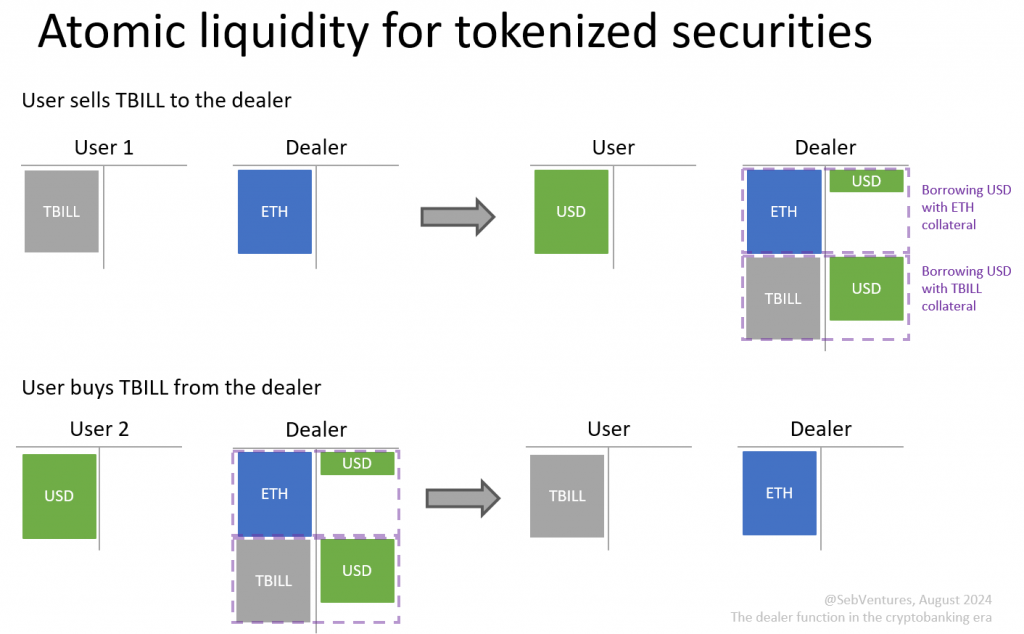

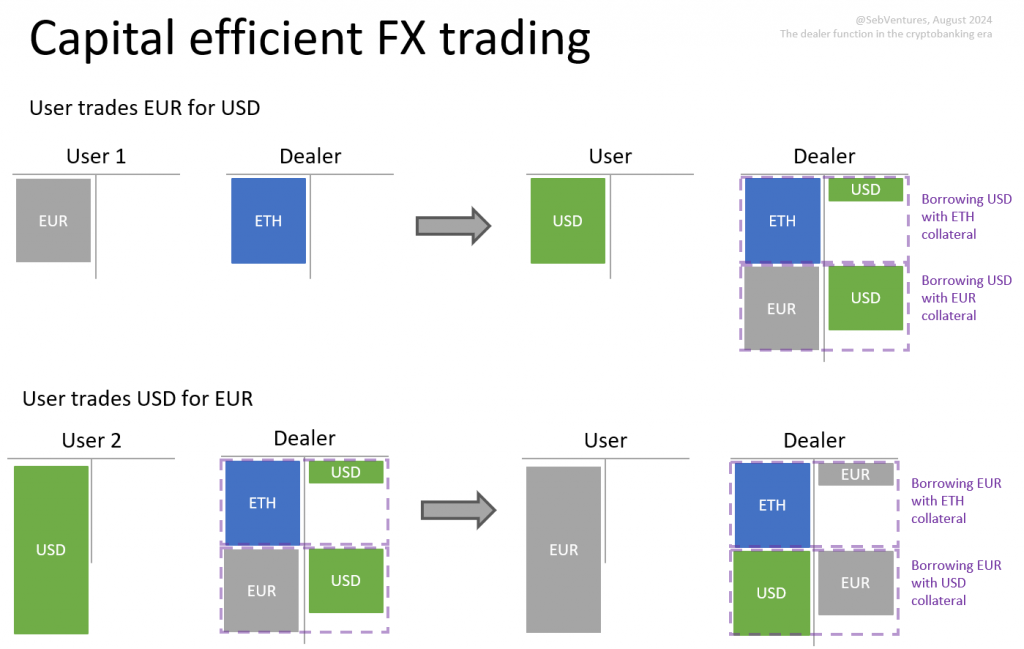

Capital efficient FX trading

The second use case we explore involves FX markets (stablecoins denominated in different currencies). FX markets are characterized by moderate correlation and volatility. This necessitates providing liquidity across a wide range, but with relatively low trading fees due to the limited volatility. Employing just-in-time liquidity could significantly reduce the burden of unused capital.

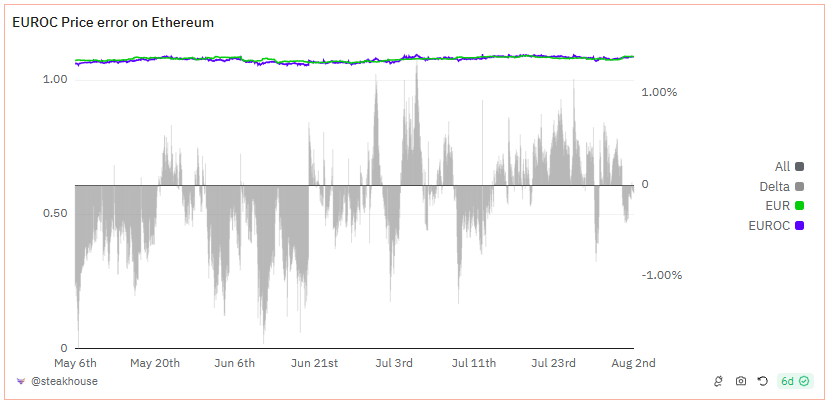

Furthermore, FX markets exhibit another distinct characteristic: the most accurate price is often found off-chain, while the on-chain price tends to fluctuate around it, as illustrated by the EURC price compared to the EUR below.

In this use case, the Dealer assumes FX risk since its balance sheet is unhedged, being long EUR and short USD after the trade. Similar to the previous use case, this exposure would be temporary. However, even within a short timeframe, currency movements could exceed the spread incorporated into the Dealer’s price.

If the Dealer needs to roll over the position due to currency fluctuations, profitability would depend on trading fees (spread) + yield on collateral – funding cost. Assuming the yield on collateral is close to the funding cost, the initial carry cost would be negligible. However, it would increase if the borrowed currency appreciates against the collateral currency. Importantly, the cost would be limited to this small tranche, without incurring a capital cost for the entire liquidity range provided (the initial ETH seed should remain small relative to the liquidity range).

Leveraging Lending Markets: How Dealers Unlock Capital

As we’ve highlighted, the funding structure plays a central role in enabling liquidity provision. Dealers, while potentially taking on speculative risk depending on the asset they’re backing, receive a one-time fee (if activated) but also face funding costs until the position is closed. This dynamic creates a nuanced risk-reward balance for dealers in which there is a lot to explore.

In our example, the Dealer was seeded with ETH, underscoring the flexibility of the funding model – the capital doesn’t need to be directly tied to the traded assets. It simply acts as collateral, enhancing the Dealer’s borrowing capacity. This implies that with a fixed amount of capital (like the ETH in our example), a single Dealer could potentially support multiple markets. The maximum liquidity provided could likely reach around ten times the initial capital.

Critically, the actual liquidity originates from lending markets. Adequate liquidity at a reasonable cost is essential for this mechanism to function effectively. The whole design is based on the synergy of AMM (Automated Market Makers) and lending protocols.

The Dealer model isn’t just a promising path; it is a new building block based on the AMM and lending primitives, poised to unleash a new era of capital efficiency and deep liquidity, leaving behind the limitations of traditional pools and ushering in a future where the best of TradFi and blockchain converge.