Stablecoins: currency or credit?

and the case of DAI

In this article, we will analyze the difference between money-like credit and a currency. Then we will try to understand how such a dichotomy related to the stablecoin construct, in particular DAI, the MakerDAO stablecoin.

Money-like credit versus currency

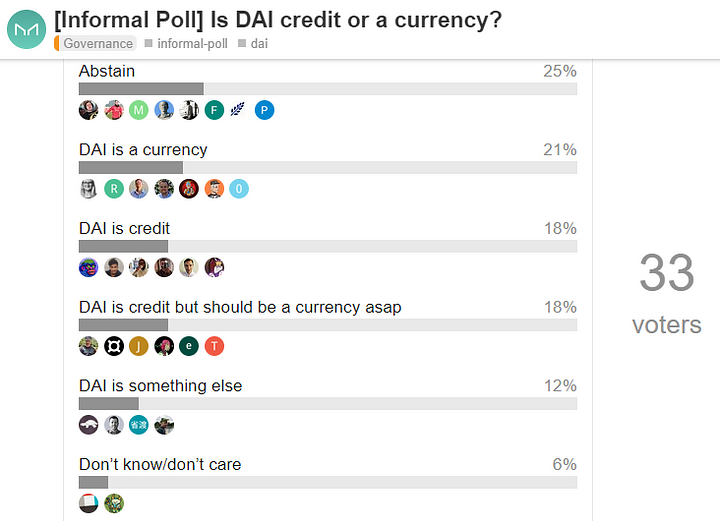

In a poll on MakerDAO forum, I’ve asked the community if they see DAI as credit or as a currency. Results where unexpecting quite uniformly distributed.

First, let’s define what we mean by currency and credit.

A currency is defined here as a system of money. It is commonly defined as store of value, medium of exchange and unit of account. A more detailed presentation is given in The 7th Property: Bitcoin and the Monetary Revolution.

In our case, the most import point of a currency is the unit of account. Indeed, we are using a more broader definition of currency as a system of money. You can also read my article How Money Works for a simple explanation and Crypto-Banking 101 where I detail more in depth hierarchies of money.

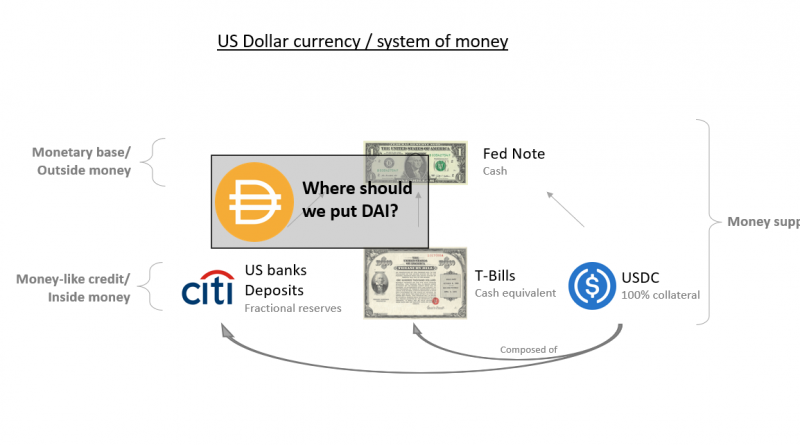

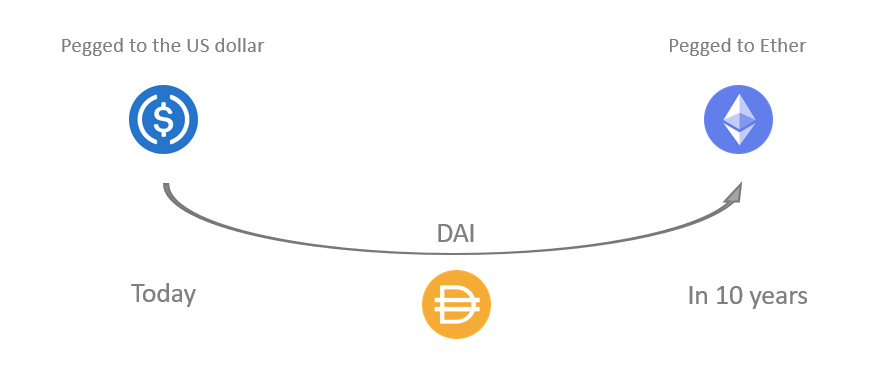

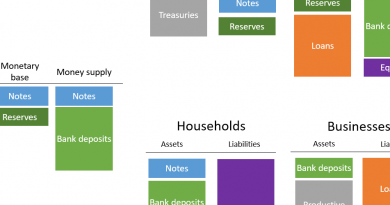

For the scope of this article, I will refer to the following diagram representing the US Dollar currency / system of money. At the top there is the Fed Note (and Fed reserves not displayed for simplicity). This is the monetary base, or layer 1, of this system. It is the most pristine US Dollar. But the money supply (everything that we might consider US Dollar cash or cash equivalent) is broader and encompass banks deposits, Treasury Bills and stablecoins like USDC. Those are not cash but credit instruments with high moneyness (claims on higher level money). It feels like a Fed note but isn’t.

Therefore, the original question is to know if DAI is part of the US Dollar currency tree (like USDC, at the inside money level), or if DAI (the token) is the monetary base of the Dai currency tree (at the outside money level, i.e. first layer).

The case of DAI

While the “contractual engagement” (if any) is only to allow redeem of DAI for $1 at emergency shutdown, those last years, MakerDAO always provided ways to go from/to DAI to/from USDC. In a way, it is commercially expected.

The MakerDAO Whitepaper assumes DAI as a unit of account. Nevertheless, the paper recognize that it is not widely used beyond the protocol itself. It feels akin saying the Citigroup IT system express everything in Citi $.

Dai is not used as a standard measurement of value in the off-chain world, it functions as a unit of account within the Maker Protocol and some blockchain dapps

MakerDAO whitepaper

Currently the stablecoin ecosystem is mainly driven by $-linked stablecoins. While there is more than $100 billions of $-linked stablecoins, the next represented currency, the Euro, is far below 1 billions €. The crypto-banking system is a US dollar world. Some experiments are trying to create a stable currency using a new unit of account, like RAI, but are limited to niche markets. Even speculative crypto-currencies (BTC, ETH) have less daily volume than the $-stablecoins.

We are in a world of intense competition and, to thrive, a new currency should provide a new value. Fiat currencies around the world have the avantage of being legal tender in their country. The US dollars is currently the unit of account of the international trade. That might change in the future for the benefit of another national currency or a return to hard money in the form of a commodity standard (e.g. gold) or based on a crypto-currency (BTC, ETH, …).

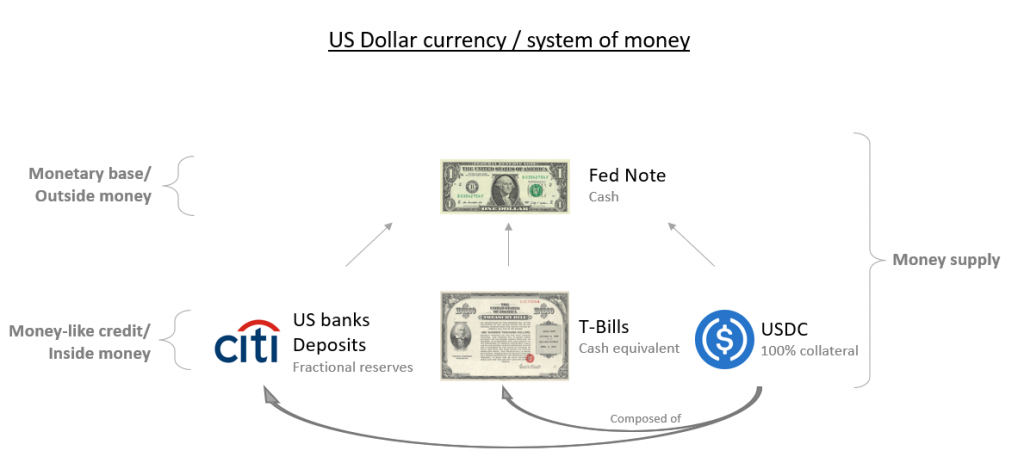

Therefore, my view is that DAI is clearly in the credit side in the US Dollar system. Nevertheless, DAI could keep the optionality to migrate to a new unit of account system (or a basket, like the SDR). For that, it will have to be used as a strong brand inside a community. Maybe to ETH could be the currency when/if it will be recognized as the international unit of account?