How to fix the par value of stablecoins

In the real world, a one-dollar bill has the same value as $1 at your Citigroup account or $1 at DBS Bank in Indonesia. You can go from one to another quite easily at no cost (besides using an antiquated infrastructure).

Yet in DeFi world, going from 1 USDC to 1 DAI to 1 FEI is quite costly (not speaking of the transaction fees on L1 which is outside the scope of this article).

In Stablecoin design: liquidity, I made the case that not solving this problem is a conscious decision. If free banking Scotland or the Suffolk system were able to solve the problem hundred of years ago, we should be able as well.

Stablecoin is credit

In its essence, a stablecoin is a credit position. Holding 100 USDC is the same as saying you are lending $100 to Circle.

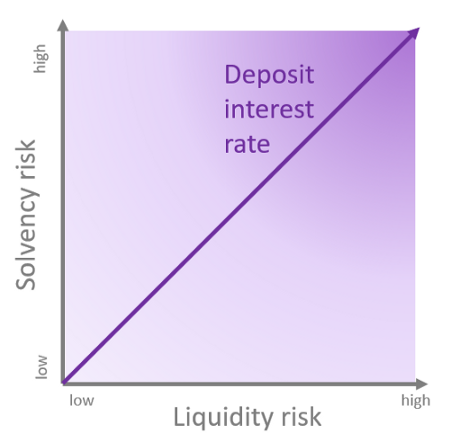

From the crypto-banking 101 article, I expect the risk-free interest rate on a stablecoin (like the DSR for MakerDAO) to be a function of the solvency risk and liquidity risk.

Liquidity risk is the risk that the stablecoin is not swappable for $1 at a given time. MakerDAO solved that with the PSM, first for USDC and now USDP. As those are convertible to fiat $ this brings DAI -> $ convertibility. We have 60% of such liquidity, so the liquidity risk is very low (while there are no fees on the DAI -> USDC way, there are fees on the USDC -> DAI way).

Therefore, we are extending a $3,045M loan to Circle and $348M loan to Paxos. The full credit line to Circle is $10B. Quite a significant counterparty risk we are taking, but that’s the cost of providing low liquidity risk and aiming for par.

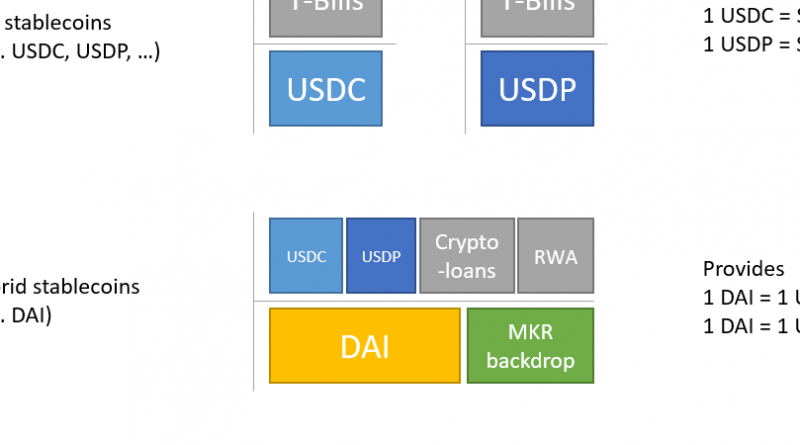

On the other hand, solvency risk is the risk of a stablecoin not being worth $1 of collateral. Solvency risk is a function of the risk of the assets backing the stablecoin and the amount of equity cushion. USDC is backed by t-bills, so very low risk even if there is no equity. On the other hand, FEI is backed by volatile crypto-assets (ETH mainly) but some comfort is given to stablecoin holders with a huge equity cushion. DAI is in between.

Making stablecoin traded at par

The solution for every stablecoin being traded at par is for them to provide a free arbitrage facility with another stablecoin. In such a network, if one stablecoin has a fiat redeemability facility, all stablecoins will be worth $1 thanks to a risk-free arbitrage.

Obviously, there is always a risk that one counterparty goes insolvent (liabilities > assets). This will lead to a bank run (for lack of a better word) which will create an exodus of safe stablecoins from the failing stablecoin balance sheet. Nevertheless, in normal times, 1 stablecoin = $1. Something we don’t have yet.

A hierarchy of money can be the following. Fiat stablecoin would provide the bridge to fiat currencies. Hybrid stablecoin, like DAI, would have liquidity facility (like PSM) to those fiat stablecoins (limiting the counterparty exposure). I call those stablecoin hybrids as they are both decentralized yet dealing with the real world (through fiat stablecoin and real-world assets). The last kind is crypto-pure stablecoins that have no direct link with the real world. Thanks to counterparty exposure limits and the hybrid stablecoins backdrop, they should not be impacted by real-world events.

This system should move the discussion around balance sheet composition and stablecoin participation in the balance sheet results. Some customers will prefer a crypto-pure stablecoin that is quite secure (sound balance sheet management). Some will prefer fiat stablecoin even if they are centralized. Some will prefer holding a more risky stablecoin that provides a risk-free yield (sharing part of the profits of the assets).

The solution is based on the Suffolk system. MakerDAO should provide 0 fees PSM with all major fiat stablecoin. We could limit single counterparty risk to 10% (or a Surplus Buffer multiple) and target total fiat stablecoins to 30% of DAI issuance (until a better understanding of DAI liquidity demand is done). This would ensure 1 DAI = $1.

From there every new crypto stablecoin could anchor to DAI (and other similar hybrid stablecoin) and/or to the fiat stablecoins (which don’t have the MKR backdrop). It doesn’t have to be hierarchical either (but fiat stablecoins will most likely not participate), this is merely a representation and no doubt creativity will bring new solutions.

MakerDAO is ideally positioned to provide a reserve stablecoin. We are a mature protocol and already have huge reserves of fiat stablecoins. As a benefit, crypto-stablecoin protocols will extend credit to us to access this liquidity pool and achieve par value. Moreover, it will be good from real-world assets.