MakerDAO — Borrowers concentration analysis

Summary

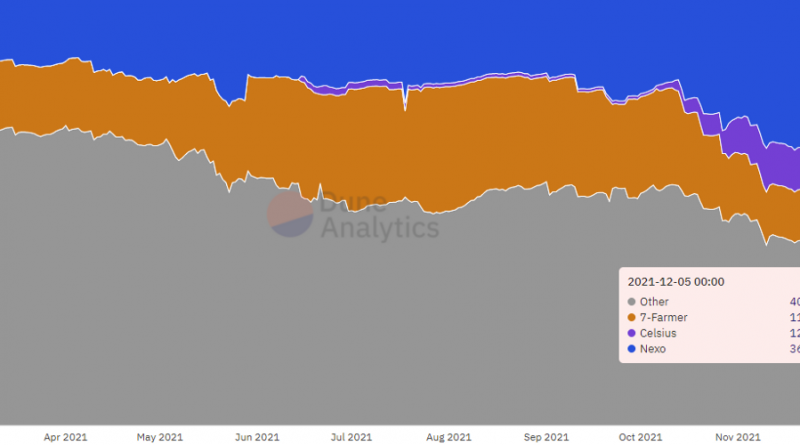

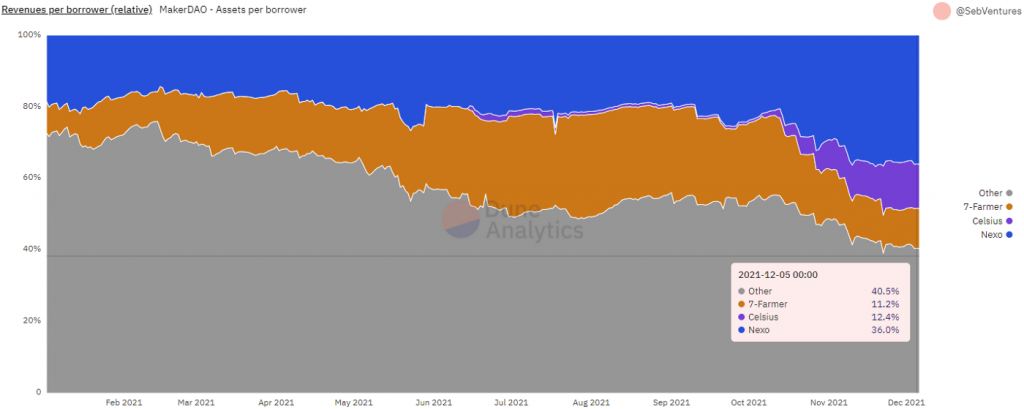

- Borrower concentration at MakerDAO is increasing over time

- 3 borrowers are currently ~55% of our crypto-loans exposure and ~60% of our crypto-loans revenues

- 2 of those borrowers are CeDeFi platforms and represent 45% of our crypto-loans exposure and ~50% of our crypto-loans revenues

- Efforts to diversify our borrower base should continue to limit one customer actions from impacting too much our balance sheet

Part of an ALM work and originally published here

Motivation

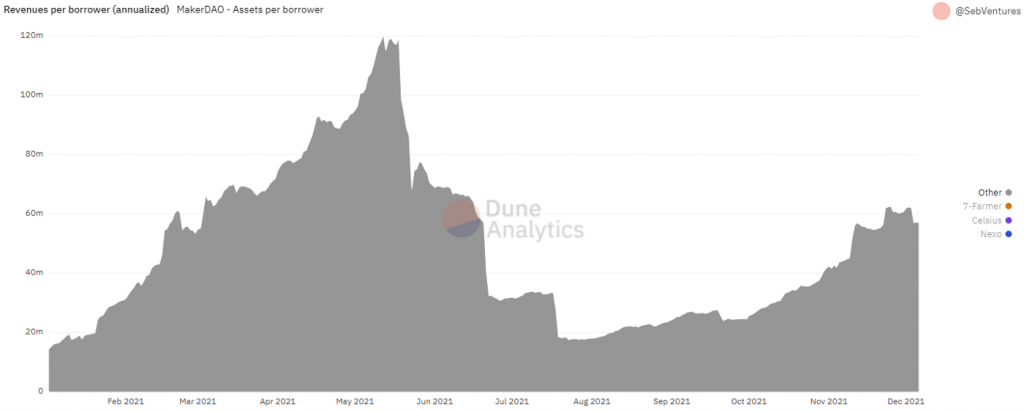

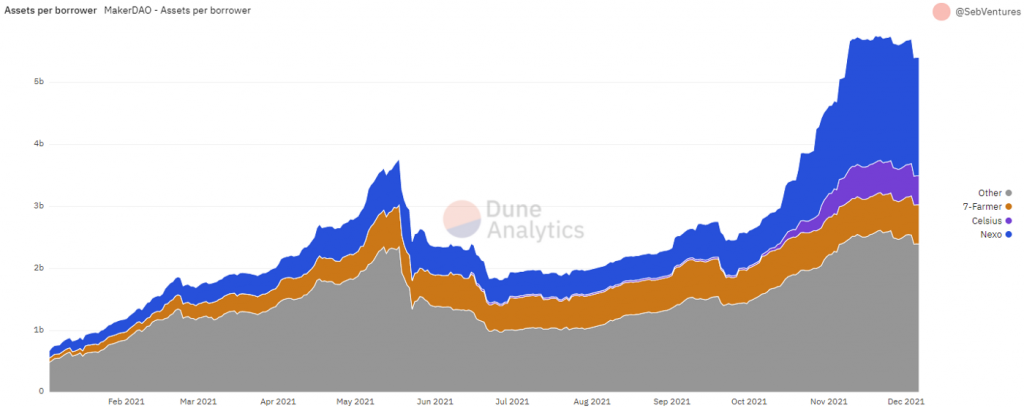

Maker is a lending protocol with more than $5.5B of crypto-backed loans. Interests on those loans are the main revenue source of the protocol. It is also the main supply of DAI. A decrease in crypto-loans outstanding would increase the fiat stablecoin PSMs and decrease revenues. Both are not favorable outcomes for MakerDAO in the current context.

Asset-Liability Management (ALM) on the analysis and optimization of the balance sheet (broadly DAI demand and DAI supply) in order to limit risks and optimize MKR returns (in terms of profitability and/or volatility of those profits). One of those risks is the concentration of borrowers which is the topic of this study. Credit and market risks are outside of this analysis.

Methodology

Dune Analytics was used to create the queries to find exposure and revenues per vaults. The biggest vault users were identified by using the Risk CU website. Risk CU added a metric related to this analysis recently as well that @josolnik discussed here.

Numbers are limited to crypto-loans vaults and exclude stablecoins-vaults (both PSM and traditional vaults), RWAs vaults, and D3M. They include Liquidity Pools like GUNI-DAI/USDC.

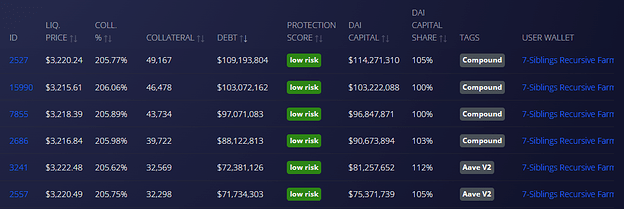

The borrower nicknamed 7-Farmer is a collection of 7 wallets identified by Risk as having the same pattern of usage, therefore most likely belonging to the same customer.

There is a live dashboard that tracks the metrics displayed in this analysis. It also contains sources of the queries.

Data presented here are up to December 6st, 2021.

Findings

The concentration of borrowers over time

The most striking result is that MakerDAO is more and more exposed to the 3 main borrowers. They now represent around 55% of the crypto-lending activity of MakerDAO and not far from 60% of the revenues.

If we remove those 3 borrowers, we are down 52% from peak revenues.

Moreover, as shown below, since the May peak, the vast majority of the increasing DAI supply from crypto-loans is due to those 3 borrowers.

CeDeFi is the main driver of crypto-loans

Of the 3 biggest borrowers, 2 are CeFi platforms: Nexo and Celsius. Their behavior is to pledge crypto-collateral, mint DAI and convert it to US Dollars to lend them to their customers. They are acting as a regulated intermediary between retail and DeFi.

Combined Nexo and Celsius represent around 45% of the crypto-loans exposure and around 50% of the protocol revenues. It might therefore be important to understand the main drivers of CeFi lending activities as they are influencing significantly the MakerDAO balance sheet.

The efforts of Growth to foster an institutional vault initiative and better B2B relationships might help significantly to avoid CeDeFi borrower churn and increase this kind of borrower exposure. While an exciting opportunity, it also represents a medium ALM issue of increasing our stablecoins exposure above what we would consider enough (as they are DAI sellers).

Indeed, should Nexo close its relationship with MakerDAO, the PSMs (most likely USDC) would increase by $2B to reach $5.3B. This would move our liquidity buffer in terms of DAI from 36% to 57%. Such a level was considered excessive and prone to an unacceptable regulatory risk (USDC freeze of the PSM) by the community in the past.

The second whale is less risky from an ALM standpoint

The 7-Farmer customer is borrowing to earn a spread by farming on Aave and Compound.

From the Risk website, we can see that DAI Capital Share is around 100%. The customer is delta-hedged in terms of DAI (around the same amount of DAI-denominated assets and DAI-denominated liabilities).

The ALM risk of this customer is therefore quite limited. If he unwinds his positions, both the asset and liabilities part of MakerDAO will decrease i.e. this will not significantly impact the stablecoin exposure nor the DAI price.

It is nevertheless 15M DAI of annual revenues that could vanish should the spread between ETH-A Stability Fees and yields on Aave/Compound become negative. This should be taken into consideration when setting the Stability Fees.

Conclusion

The analysis shows the value of having closer relationships with those key customers like it is developed with Institutional Vaults. As at least 45% of the crypto-loans exposure is owned by CeFi platforms, this can be a trend towards CeDeFi (at least in the scope of Maker), with CeFi focusing on customer acquisition and experience while DeFi works in the background.

While this trend is good for MakerDAO (allowing it to indirectly reach a wider audience than DeFi only), efforts should probably continue to increase the diversification of our borrower base. We should avoid having a particular borrower being able to significantly impact MakerDAO’s balance sheet.